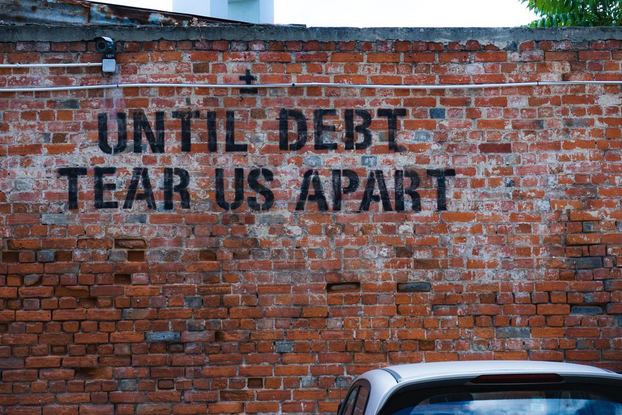

Students and young professionals today have been raised in ads cultural environment that relies heavily on debt for day to day survival. Debt has become such a common part of the typical American home today, that it almost seems “Un-American” to live a debt-free lifestyle. Take a look at some of these startling numbers:

- The average debt per household for households that have a credit card is $15,983 (Nerdwallet).

- Average credit card interest rate- 13.64% (Valuepenguin.com)

- Average mortgage debt per household- $178,037 (Nerdwallet)

- Average student loan- $47,047 (Nerdwallet)

- Only 52% of households have emergency savings that exceed their credit card debt (Bankrate).

It seems that the American Dream should be renamed American Debt. There is an overwhelming belief in our American culture that, using debt, you can get whatever you want…now. Why is debt such a powerful, addictive force, especially for young people? Well, there are two main reasons:

- The desire for instant gratification. We want what we want NOW BEFORE we work for it; rather than working for what we want BEFORE we make the purchase.

- No cash passes through your hands, so you register very little emotional realization that you’ve just spent money.

People tend to struggle to admit that they have a debt problem. Many students and millennial workers convince themselves that their debt is under control. However, let’s take a look at some of the cold hard facts:

- A 2002 study found that 80 percent of consumers state that their credit cards are at or near their credit limits.

- In the same study, 37 percent had taken cash advances from one credit card to pay off another card.

- Studies have shown that the typical grocery purchase doubles with the use of plastic.

So, while we think that our debt is under control, for very many this is not true. The first step to getting out of debt is to admit that debt is a problem in your life. Once you have made this admission and you are wholeheartedly committed to getting out of debt, you will have the emotional firepower to follow the steps below.

How to Get Out Of Debt

The steps below are taken from Dave Ramsey’s book, Financial Peace (which by the way is a fantastic read, and should be one of the foundational books that you read as you begin your wallet wisdom journey.)

1. Quit Borrowing Money!

As Ramsey puts it, “The first step towards getting out of a hole is, ‘stop digging!'” While this may seem silly, it’s also very true. You will never achieve victory over debt in your life until you make a serious decision to stop borrowing money. You have to make a conscious decision that “With the exception of a home, I’m not going to borrow money on ANYTHING, EVER AGAIN,” and you need to stick to that decision no matter how hard things may get.

2. The Debt Snowball

This is the tried and true method for creating an actionable plan to retiring your debt. It works like this. First, put your debts in ascending order, with the smallest remaining balance first and the largest last. Once you’ve paid off your smallest debt, take the extra income that you will have freed up from your monthly budget, and use it to pay extra each month on the second debt on your list.

Slowly, you will begin to pick up speed, and your debts will begin being paid down faster and faster. This is why this strategy is called the debt snowball.

This strategy helps psychologically as well. As you experience small “wins,” it encourages and energizes you to continue your debt dump. Following this strategy, you will be able to pay off all of your debts much faster than you may have ever thought was possible!

If you’re looking to start your debt snowball, here’s a great online calculator to help you get started.

3. Save!

If you do not save money, “emergency” situations will always come up that force you to go into debt in order to cover the expense. The formula is very simple. If you do not save, you will never be able to conquer debt. Saving is so important, yet no one does it! The typical American saves less than 5% of their income.

How much is the right amount to save? Ultimately, you have to decide that for yourself, but the general consensus of financial gurus is if you save 10-15% of your income each year, you will find yourself able to retire comfortably when you reach retirement age.

The bottom line is, you will never be successful financially until you kick your debt in the pants and get it out of your life. The good news is, so many people have already taken this journey before you and you can do it too!

One final note – if you are specifically trying to get out of student loan debt as opposed to mostly consumer debt, be sure to check out our guide on “How to Get Out of Student Loan Debt.” Now get going and start dumping that debt and start changing your financial future!