If you're wondering how to invest in your 20s, that's a great thing. For many millennials, investing isn't even on their radar. The St. Louis Fed recently found that three out of five millennials lack start market exposure.

There are a lot of misconceptions about investing in the stock market. Many have heard the horror stories of good folks who invested their money in the stock market and lost everything. It's no wonder that so many young people are gun-shy.

But, in reality, there are few better ways for a person in their 20s to build wealth. And by following the right principles, the stock market can be a huge boost to your wallet in retirement.

With that thought in mind, let's take a look at how to invest in your 20's.

1. Plan Your Investments for Long-Term Success.

As an investor in your 20s, do you know what your best investment tools are? Time and compound interest.

To illustrate this principle, let me give you three scenarios.

- 20-year-old investor puts $1,000 in an investment. Each month, he adds $100.

- 30-year-old investor puts $1,000 in an investment. Each month, he adds $200.

- 40-year-old investor puts $5,000 in an investment. Each month, he adds $400.

For sake of illustration, we’ll say each investment makes a 10% annual interest rate (Historically, the 30-year return of the S&P 500 has been right around 10%).

Who do you think will have the most money at retirement age 65? The man who began at age 20.

- $1,239,205 - ending value at retirement for the investor who began at age 20

- $905,308 - ending value at retirement for the investor who began at age 30

- $704,957 - ending value at retirement for the investor who began at age 40

If you're thinking about how to invest in your 20s, this should excite you! If you invest on a regular basis and let time and compound interest run its course, you will end up with a very secure retirement.

But where most investors get into trouble is when they try to get in a hurry. Always be wary of “get rich quick” schemes. These have been the downfall of countless investors over the years.

Always remember, the quickest way to get rich, is to not get rich quick. It’s through daily making wise choices: getting out of debt and staying out of debt, spending less than you make, and investing wisely.

Over the short term, even the best of stocks or mutual funds may lose money. But very few even mediocre mutual funds lose money over the long-term.

How Long Should I Plan to Stay in an Investment?

Ibbotson yearbook, a reference on many mutual fund broker’s desks, advises that if you had invested in the short term, just one year, in small company stocks you would have lost money 20 of the last 69 years.

Ibbotson also found that if you had left your investment alone in any possible 10-year period in the last 69 years, you would have made money 97% of the time and would have averaged over 10% per year.

One rule of thumb is that if you have money that you will need to spend in less than 5 years, don’t invest it. Keep it in savings.

Any investment can do down in value with a time horizon of fewer than 5 years. Typically though, if you will not need the money for over 5 years, then it's wise to invest it.

2. Invest Methodically and Consistently.

Many would-be investors try to wait for the “perfect” time to invest, a time when there is absolutely no risk in the current economic environment. There will never be such a time!

Similarly, many young investors try to “time” the market. They jump in when the market looks like it’s heading in a positive direction. And they jump out when it’s looking bleak. They are constantly jumping in and out, in and out.

Don't Try to Time the Market

But the problem with this is you can never know how high the market will rise, and how far the market will drop. So guess what happens? You end up selling too early, (missing out on the continued growth of the investment) and buying too late (buying after it’s reached its lowest point, and has started moving upward again).

Investors that try to time the market are notorious for constantly buying too high and selling too low. In his Business Insider piece, Cost of Missing the 10 Best Days in the S&P 500, Sam Ro had this to say.

Most investors are terrible at trading. When the market starts to selling off sharply, investors will panic, sell their own shares, and sit on the sidelines. Unfortunately, some of the biggest one-day upswings in the market occur during these volatile periods."

Missing out on just a few of these good days can cost you buckets of cash.

In the same Business Insider article, Ro shared the following quote from JP Asset Management's Guide to Retirement.

If an investor stayed fully invested in the S&P 500 from 1993 to 2013, they would’ve had a 9.2% annualized return. However, if trading resulted in them missing just the 10 best days during that same period, those annualized results would collapse to 5.4% Missing those days, does so much damage because those missed gains aren’t able to compound during the rest of the investment period.

So what does JP Asset Management suggest?

Plan to stay invested. Trying to time the market is extremely difficult to do consistently. Market lows often result in emotional decision making."

Remember the story of the tortoise and the hare? As an investor, you want to be the tortoise! Slow, methodical, building and increasing of your investments is the way to go.

Instead of trying to guess the best time to invest your money, you should just consistently invest a small portion of your income every month.

Dollar-Cost Averaging

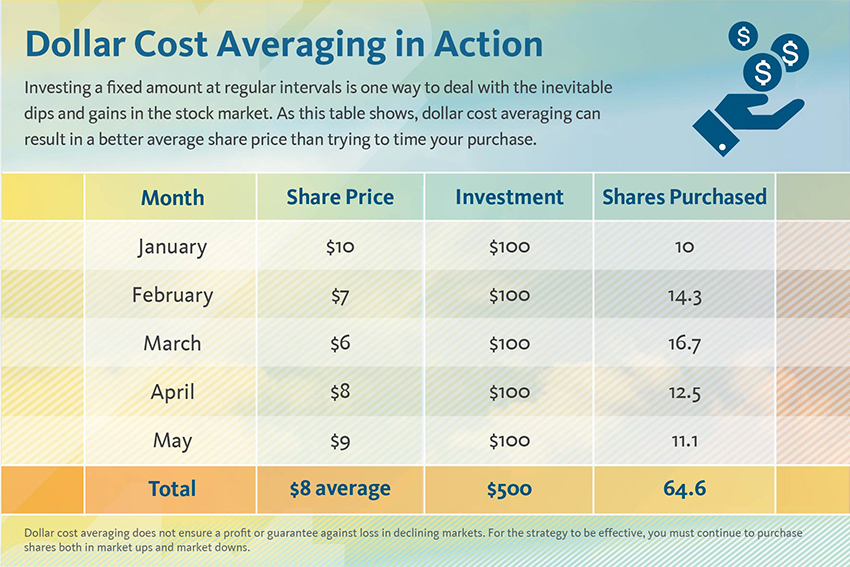

But how do you do this? Well, today, this is easier than ever to do thanks to the availability of mutual funds/index funds and thanks to the principle of dollar-cost averaging.

Mutual funds are different than individual stocks in that you can buy fractional amounts of them. For instance, if a particular mutual fund cost $35 per share and you have $50 to invest, you can buy 1.42 shares of that mutual fund.

You can’t do this with individual stocks. If you want to buy Coke stock, and a share of that stock is $95, then you have to wait to buy until you have the full $95.

Because you can buy fractional amounts of mutual funds, you can choose to invest the same amount of money each and every month in that fund (or several funds). So, in months when the stock market is up, your money buys you fewer shares; for months when the market is down, your money buys you more shares.

Below, you can see a chart from the University of California that visualizes this process. Dollar-cost averaging is a spectacular way to balance your risk when investing in the stock market.

3. Keep a Close Eye on the Cost of Your Investments.

Many people don't realize that every time you invest in a stock or a mutual fund, there are costs involved.

You must be aware of these costs because when are too high, they dramatically change how much your money can grow over time. What are three key costs associated with investments?

Brokerage Firm Cost

Many brokerage firms charge ridiculous fees and commissions as a thank-you for being their customer. There are several low-cost brokerage firms today that you will save you lots of money.

Vanguard is the most popular, but there are many other great choices, such as Charles Schwab, Fidelity, T. Rowe Price, TIIA-CREF, and many more.

With each of these choices, you can buy and sell in-house mutual funds with no trading charge. Many of these brokers now allow you to sell ETFs for free as well.

Mutual Fund Purchase Cost

Many mutual funds charge you an up-front fee upon purchase. This is often called a front-end load. These fees can be anywhere from 3, to 4, to 5, to 6% of your initial investment! So let’s think about this for a second.

If you put $10,000 into a mutual fund that has a 5% front-end load, then you lose $500 right off the top!

Where does this money go? To the brokerage firm or the broker that you are working with. It is given to them as an incentive for selling you the fund. That’s why Bill Barker from The Motley Fool explains that when a broker recommends a fund to a client, the fund will in all probability be a load fund.

Here's what Adam Bold had to say in his Us News says article Why Investors Should Avoid Load Funds.

If a fund carries a 5.75% front-end load, the broker will get $575 for every $10,000 you invest in the fund. That leaves you just $9,425 to start with. This means you have to earn back the $575 that was paid to the broker to just break even. You also lose the compounding of the load amount as the market rises.

Here's what else Bold had to say.

Loads can also cause investors to feel trapped in an investment. If you buy a load fund and want to sell it, the broker may want to sell you another load fund, which means you'll have to pay another commission. Instead of selling it, you might stick with the fund longer than you should.”

Another thing that you should know about load funds is their performance numbers do not include the load.

When looking at fund performance data on sites like Morningstar, those returns are net of fees and expenses that the mutual fund company charges, but they're not net of the load. In other words, returns that investors get from a load fund will actually be less than the returns commonly published.

Mutual Fund Management Cost

This is a biggie that most don’t know to look at. Mutual funds have ongoing expenses that are known as the expense ratio of the fund.

The expense ratio includes the cost of hiring the fund manager and the administrative costs of the fund. These expense ratios typically range from 0.5 percent to 2% of your investment.

Are high fees worth it? You get what you pay for, right? Wrong.

Just about every study ever done has shown no correlation between high expense ratios and high returns. And you can see from the Vanguard chart below, high fees can really hurt your overall return.

Index Funds

Are there affordable mutual funds out there? Absolutely!

One of the best ways to minimize the expense ratio of your mutual fund portfolio is to invest in index funds.

Instead of hiring a fund manager who decides what stocks should and should not be in the fund, index funds simply follow certain common market indexes, like the S&P 500 for example.

- An S&P 500 index fund, for example, would include the stocks of every company that is in the S&P 500. There is no thought involved. It’s automatic.

- As the companies in the S&P 500 change, the index fund changes as well. When the S&P 500 goes up, your index fund goes up. When the S&P 500 goes down, your fund goes down. It’s very simple, clean, and requires very little management, which results in much, much lower operating costs.

While the average mutual fund will have a cost between 1% and 2%, the average index fund cost will be under 0.5%. I personally own shares of an index fund with an expense ratio of 0.09 percent.

4. Take Advantage of Tax-Saving Opportunities.

Another important factor that many investors fail to take into account is the amount of taxes that they pay on their investment. This can make a huge difference in your overall return.

In order to encourage Americans to save money for retirement, the government has created tax-saving opportunities. To not take advantage of these is foolish.

The three most common tax-advantaged retirement accounts used today are 401(k), Traditional IRA, and Roth IRA. Traditional IRAs and 401(k)s offer nearly identical tax advantages, but they do have other things that make them different.

| IRA | 401k |

|---|---|

| Anyone with earned income can create one. | Must be employed a particular company to get access to their 401k |

| Usually able to invest in nearly any investment of your choice | Typically offer a limited number of funds/stocks for you to invest in (many of which are expensive choices) |

| As long as you have earned income, you can contribute up to $5,500 annually. | The employer decides who can and cannot contribute, and also decides how much employees can contribute annually. |

| You can pick any discount broker of your choosing. | Often have high expenses and fees dedicated to account management. |

401k vs. IRA

Due to all the reasons explained above, an IRA is typically a better choice for your retirement money, but there is a key exception to this rule.

If you are offered an employer match for your contributions, then this definitely makes your 401(k) the best choice for you.

Traditional vs. Roth IRA

Now, what about a Traditional IRA versus a Roth IRA? Most would say that for those in their 20s and 30s, a Roth IRA is their best choice, while a Traditional IRA can often be a better choice for those in their 40s and 50s.

However, in my article comparing the Roth and the Traditional IRA, we learn that the real answer isn't quite so cut and dry simple.

But no matter which tax-advantaged account you use, the key is to make sure that you pick one! Unnecessary tax cost can put a big dent in your overall investment return.

Conclusion:

Choosing to invest in your 20s could end up being the smartest financial decision that you make before age 30. In fact, if you have the extra cash, I'm totally cool with you beginning to invest while you're in college. Check out this great guide to investing for college students from This Online World.

By giving your investments 30 to 50 years to grow, you'll be able to take full advantage of the magic of compound interest. Don't be afraid to invest in your 20s. But make sure that you plan to be in your investing journey for the long haul. And keep a watchful eye out for ways to save all along the way.

Enter your text here...