Founded by Travis Hornsby (CFA), Student Loan Planner is a student loan advisory service. Before diving headfirst into my Student Loan Planner review, I need to give one quick disclaimer.

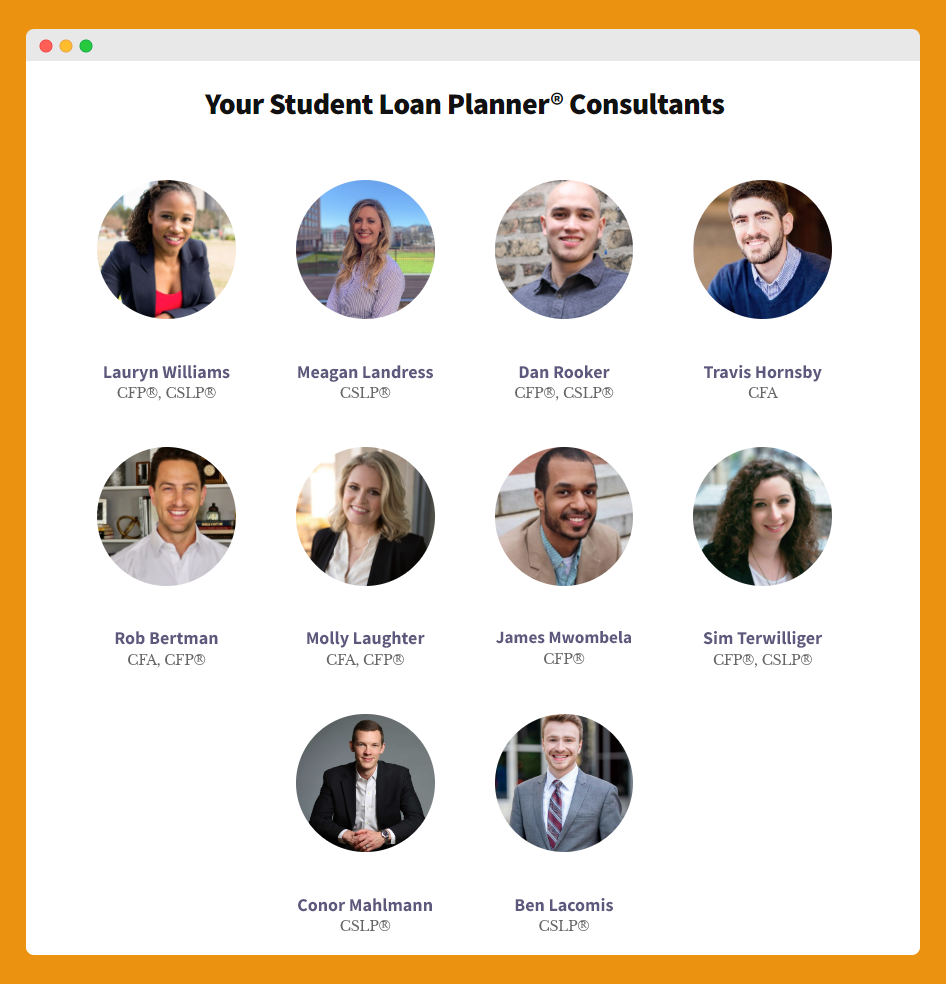

Student Loan Planner also has a blog. And before I took on the Editor-in-Chief role at Investor Junkie, I used to write for them on a regular basis (give the team photo above another glance and you’ll see yours truly on the left.)

But I wrote for a lot of websites, yet I never felt compelled to write a review of any of them.

Student Loan Planner, however, had a different kind of impact on me. Through my work with Student Loan Planner, I saw firsthand the amazing work that Travis and his team do on a daily basis.

I interviewed borrowers who received help. I read the stories of clients who had been dealing with depression (and even considered suicide) because of their student loans but felt their burden lifted after their consultation.

So while (honestly) many “coaching” and “consulting” services are a waste of money, that’s not the case with Student Loan Planner. It’s the real deal. Read my full Student Loan Planner review to learn more.

What Is a Student Loan Consultant?

A student loan advisor is someone who looks at your student loan situation and can help you pick the best repayment strategy.

- Should you use an Income-Driven Repayment (IDR) plan?

- If so, which IDR plan would save you the most money?

- Should you refinance?

- Should you pursue Public Service Loan Forgiveness (PSLF)?

A student loan consultant can help you navigate these student loan questions. Unfortunately, the student loan industry is incredibly complex.

Choosing the wrong repayment strategy can cost you tens, and in some situations, hundreds of thousands of dollars. And with the COVID-19 payment pause on federal student loans set to end in January 2023, student loans will once again become a critical financial issue for millions of households.

What Makes Travis and the Student Loan Planner Team Different?

Although there are other student loan advisory services out there, there are a few things that set Travis and his team apart. Here’s why I can highly recommend them.

1. Expert Knowledge and Advice

When I started writing about personal finance, I thought I knew a lot about student loans.

And then I met Travis Hornsby.

Travis is an absolute encyclopedia of student loan information. I’ve learned so much from him about the intricacies of student loan repayment and continue to each week.

Travis is a CFA. And before he began Student Loan Planner he was a bond trader for one of the world’s largest investment companies. But he left Wall Street because he wanted to help people with student loans. His wife is a physician and he was shocked by the amount of student debt she was saddled with.

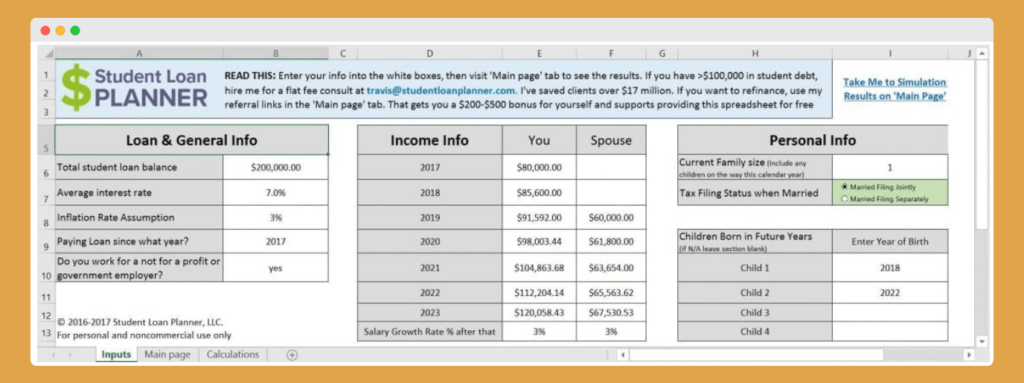

To decide which repayment strategy would be most affordable, he built the world’s best student loan calculator (like any normal person would). His calculator doesn’t just take the loan total and interest rate into account. It considers a host of factors including:

- Income

- Marital status

- Whether or not you have kids

- Where you work (private or public sector).

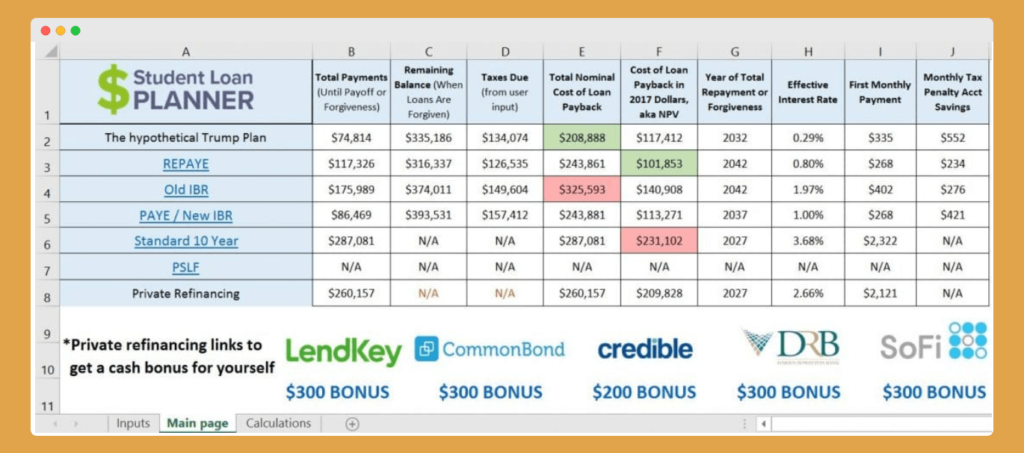

The Student Loan Planner calculator will compare the 10-Year Standard Repayment Plan, vs IDR, vs refinancing. And it will even compare each type of IDR plan to show you which one could save you the most money.

But the calculator was just the beginning. Not long after building the calculator, people started bombarding Travis with student loan questions. And eventually, people were even willing to pay him for consultations.

And, thus, Student Loan Planner was born.

2. Certified Consultants

As the Student Loan Planner business grew, Travis needed to add more consultants to his team. One of the things that’s really great about his team of advisors is that they all have either the CFA or CFP designation.

With Student Loan Planner, you’re not just getting advice from people who call themselves “experts.” You’re getting the chance to talk to someone who’s spent years receiving formal training and experience in the world of finance.

3. A Team That Really Cares

I know this sounds like a super subjective point. But I can’t say enough about the sincerity of the Student Loan Planner team.

Every week, the team is talking back and forth on Slack about ways to help people better. They truly feel heartbreak when they hear from readers who are overwhelmed by student loan debt. And they get all geeked up whenever they hear success stories.

Personally, it’s been refreshing to interact with people who care so deeply about their work.

Why Pay for a Student Loan Consultation?

If you’re dealing with crushing student loans, there are multiple repayment options from IDR, to PSLF, to refinancing.

But here’s the deal. Bloggers (like yours truly) have an incentive to heavily encourage the last option. Why? Because they can make a lot more money when you click on a refinancing link vs. deciding to stick with your normal repayment plan or switching to Income-Driven Repayment.

There are plenty of times that refinancing could truly save you money. But there are also many times when refinancing would not be your best decision.

The great thing about paying a flat fee for student loan advice is that you take bias out of the picture. When you meet with a consultant from Travis’ team, you don’t have to worry about conflicts of interest. Whatever is the best choice for you is what your consultant will advise you to do.

What Happens During a Student Loan Consultation?

Before you even hop on a call with on the SLP consultants, you’ll provide them with lots of information about your student debt and overall financial picture. This allows your consultant to prepare a full analysis before your chat.

During your video call, you’ll receive an in-depth review of all your options and if a better repayment strategy is available, your consultant will give you all the info and resources that you need to take action. Note that if you’re married, your spouse can sit in on the call as well.

The one-on-one calls last one hour. And after your call, you’ll have access to unlimited email support for up to 6 months. Here are some more details about how the student loan consultation process works.

How Much Does a Student Loan Planner Consultation Cost?

In the past, SLP’s consultation fee varied based on your amount of student debt. However, the fee is now standard across the board, with the exception of follow-up appointments which receive a $100 discount. Here’s the current pricing:

- New clients: $595

- Follow-up: $495

Is a consultation worth the money? In most cases, absolutely!

Student Loan Planner has helped over 9,830 clients save an average of over $49,000 over the life of their loans. Combined, their clients have received over $457 million in projected savings.

I recently recommended an SLP consultation to one of my own personal friends who had just graduated from chiropractor school with over $200,000 of student debt. He and his wife both said that they the peace of mind they received from the session was well worth their fee.

But don’t just take my word for it. Listen to their actual customers. Student Loan Planner has a 5.0-star rating on Shopper Approved from over 1,800 reviews. And if those reviews don’t convince you, check out this awesome video review from David B.

Student Loan Planner Alternatives

While there are multiple companies and apps that can help you with document prep, there aren’t many that offer fee-only student loan consultations like SLP.

One one of the few available today is StudentLoanAdvice.com, which is a subsidiary of The White Coat Investor. Currently StudentLoanAdvice (SLA) comes in $40 cheaper than Student Loan Planner and they offer 12 months of email follow-up support. Here is their current fee structure:

- New clients: $559

- Follow-up: $449

One concern I have with StudentLoanAdvice is that they don’t provide much information about the consultants that you might speak with, other than that their team is led by Andrew Paulson. According to their FAQs, this should set borrowers minds at ease that the SLA team can handle any questions you throw at them:

In addition, our team, led by Andrew Paulson who’s career in finance and specialized education in student loans, qualifies us to solve even the most complex student loan scenarios.

However, I’m not sure that a leader’s experience necessarily translates to everyone on the team being qualified to provide quality student loan advice. And while I’m sure that Andrew is very knowledgeable, information about even his own respective credentials is conspicuously absent from the site as well.

Also, unlike Student Loan Planner, SLA isn’t listed on a third-party review site like Shopper Approved or Trustpilot. So the only client reviews that I could find were the non-verified testimonials listed on their homepage.

Finally, and this is being nit-picky I know, but SLA’s marketing video (below) just isn’t doing it for me. It’s giving me hard 90s infomercial vibes. Yes, I know this has nothing to do with the quality of the advice that they may provide, but it’s not helping their cause either.

Who Would Benefit From a Student Loan Planner Consultation?

If you have over $20,000 in student loans, it could be worth it to set up a consultation. Below that, you may not get enough value out of an appointment and should probably just try to repay your loans as fast as you can.

The larger your student loan balance, the more money you could save by using Student Loan Planner. They’ve worked extensively with doctors, veterinarians, dentists, lawyers, and many other professionals that are known for accumulating large student loan balances.

Trust me when I say that no student loan balance will surprise Travis and his team. The average client that works with them has a student loan balance of over $250,000.

Conclusion:

I’m not a “glowing” review kind of guy. If you’ve read any other content on my site, you know I prefer muted and subdued praise.

But with Travis and the Student Loan Planner team, I honestly believe wholeheartedly in what they’re doing. They’re helping lots of people find student loan relief.

And if you have a high student debt total, they could very well help you too. Click here to book a Student Loan Planner consultation.