If you’re a nerd like me, then you may have had a similar feeling of satisfaction after creating your first monthly budget. After lovingly crafting it, I took pride in its perfection. It was a sort of beautiful masterpiece.

Nothing had been forgotten. Every apple and can of beans had been accounted for and every drop of gasoline. Literally, the entire month was planned out in advance. That’s how I felt.

And then life happened.

And it happened again… and again… and again. Month after month, our budget kept getting wrecked by something I hadn’t accounted for – non-monthly expenses.

And while I was worried about planning for our power bill and car insurance, I soon discovered that these non-monthly expenses were typically the cause of our budget blowing up. I call these non-monthly expenses “budget busters,” and the top 5 are listed below:

The top 5 budget busters

-

Car Repairs

- Home Repairs

- Birthdays and Holidays

- Vacations

-

Health and Pharmacy

When I first started budgeting, these things kept popping up and ruining our budget. Every single month included some sort of financial stress. I found myself begging to just catch a break and get a “normal” month. But at some point, an important realization dawned on me.

There’s no such thing as a “normal” month. Nearly every month will include at least one non-monthly expense.

Related: 8 Best Budgeting Apps for College Students

How to prepare for the budget busters

So if nearly every month will include at least one budget buster, what can you do? Below, I’ve included a 5-step process that should help you solve this big problem.

1. Estimate how much you will spend on an annual basis.

You may estimate that over the course of the year you will likely spend around $1,200 on car repairs. For birthdays and holidays, $600 may be a better estimate. And, for health and pharmacy, you may decide that $1,400 sounds about right.

2. Divide your annual expense estimates into monthly savings goals.

This is very simple to do. Just take the annual number you decided upon and divide it by 12. So for the car repair example given above, you would take $1,200 and divide by 12 to leave you with $100 that you need to save each month toward car repairs.

3. Rollover unused funds to the next month.

After your first month budgeting for non-monthly expenses, you will most likely find that for at least a few of the categories, you have money left over. That money now rolls to the next month.

So if you have a $50 monthly budget for birthdays and holidays, and you didn’t spend any of it in January, you now have $100 available to use in February.

These types of rollover funds are commonly known as “sinking funds.” How do you keep track of them? Well, if you are someone who uses a cash envelope system, it’s very easy. You just have a different envelope for each budget buster category. Whatever’s left in each envelope at the end of the month, stays there, and you just add to it.

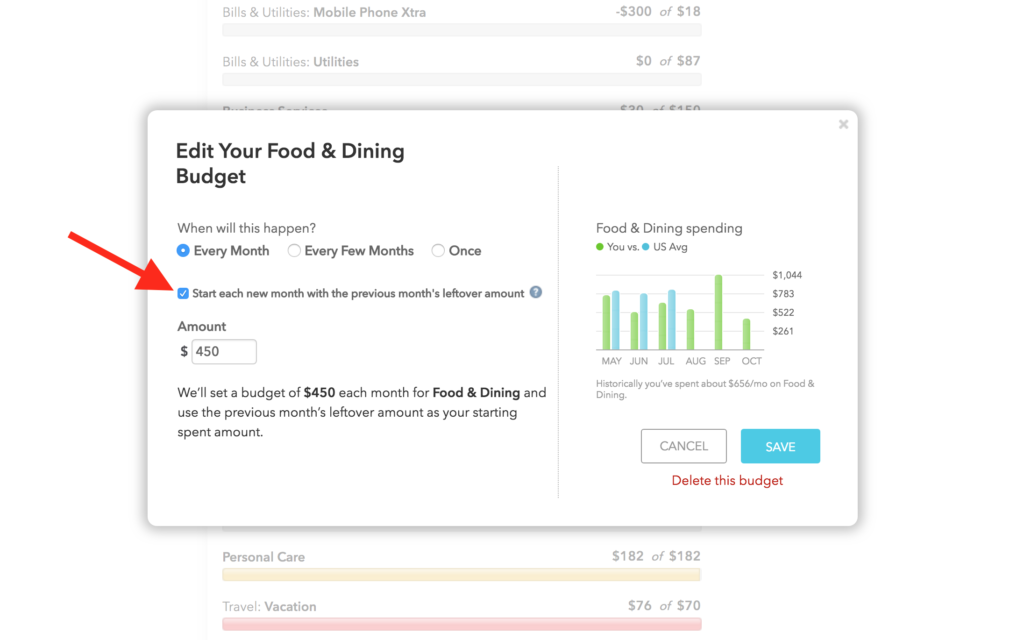

Most online budgeting platforms and apps also offer some way to create sinking funds. On Mint, for example, you just have to check the box that says “start each new month with the previous month’s leftover amount,” as shown below.

Most other budgeting programs have a similar option. You may just have to do a little digging or Googling to find them.

4. Learn and adjust.

As you first start trying to plan for the budget busters, you’re no doubt going to find that you underestimated certain categories. This will be especially true in the first few months. You will also have months at the beginning where your expenses outpace your saving.

For instance, you may have a $400 car repair hit you in February when you only have $200 in your sinking fund. So early on, you may still have to dip into your savings account once in a while to cover certain expenses, but that’s ok.

As you continue on, your sinking funds will grow and you will get better and better at accurately predicting how much you spend in each area on an annual basis. Just the fact that you are even planning at all for non-monthly expenses puts you MILES ahead of most people, so don’t beat yourself up when things don’t go perfectly according to plan!

5. Unwind!

When you start planning for the top 5 budget busters, you will be shocked at how much it will de-stress your life! It’s an amazing feeling to know that no matter what a month may bring, you will be able to handle it.

Still aren’t convinced yet that you need to do this? Well then, let me add one more thing.

Implementing this one budgeting change can also dramatically improve your marriage. A large majority of money conflict in marriage revolves around the budget busters that we’ve been talking about. Getting rid of the uncertainty around them can resolve many money arguments before they ever get started.

The bottom line: Non-monthly expenses will always be a part of your life. But with a little planning ahead, they don’t have to be your “budget busters” any longer.

This is a good post. I have found the same thing happening to my budget. I will definitely take a look into a contingency portion of the budget. I always seem to put a little fluff into some portions but it never seems to be enough.

Thanks for the tip!

Sure thing, thanks for reading!