There are lots of resources online that detail how to pay off student loan debt. We have our own guide as well. But what if you are a high schooler or the parent of a high schooler, and you would like to avoid this whole student loan mess altogether. Perhaps you’re wondering, “Is graduating without student loans even possible in 2018?”

Yes, it is. How do I know?

Because I was able to do it.

I graduated with a 4-year bachelor’s degree from a private university (a total of over $30k in tuition) with no student loan debt. And I wasn’t fortunate enough to get my school completely paid for by my parents or some other means.

So I am living proof that with some pre-planning and some hard work, it can be done. If you have a dream of avoiding student loan debt, read on to see our 13 tips for graduating without student loans.

1. Get a High School Job

I got my first part-time job when I was 15 years old. I was only working about 15 hours a week, but my parents made me save nearly every penny of money that I earned. By the time I was 16, I had ramped up my workload to about 20 hours a week, and 30 hours a week over the summer – again saving 80-90% of my earnings.

The result? By the time I was 18 and ready to head off to college, I had over $12,000 saved in the bank to help pay for nearly my entire first year’s tuition. This financial head-start was a huge reason why I was able to graduate with no student loan debt.

Thinking it will be hard to find companies that will work with high schoolers’ schedules? Think again.

Check out Snagajob’s teen jobs resource, filled with businesses that are known for hiring 16 and 17-year-olds with no work experience.

Every state is different regarding their child labor laws, but as a rule, you can’t begin working part-time until age 14. There are also rules about how long minors can work during the school year versus the summer. To check out your own state’s guidelines, click here.

2. Dual Enroll

Admittedly, this is a strategy that I really dropped the ball on, but my wife took great advantage of. Dual enrollment allows students to take college courses while they are still in high school. Usually, the courses are offered by local community colleges. But the best part? The courses are offered completely FREE, or at steep discounts compared to the tuition fees of most colleges.

I personally know many high school students that have dual enrolled at the community college in our town and have completely finished their Associate’s degree by the time they graduate high school! My wife was able to accomplish this as well, and it saved her a huge amount of money. If you can knock out your first 2-years worth of college courses through dual enrollment, you will easily save yourself anywhere from $10,000-$40,000.

For more information about dual enrolling, check out this guide on StraighterLine.

3. Take Your SAT and ACT

Regardless of whether it may be fair or not, many funding opportunities are based heavily off of your test score for these 2 exams. Most state-funded grants require a minimum SAT or ACT score, and many schools have their own private scholarships you can be awarded if you have high enough scores. Doing well on these exams could play a major role in you realizing your dream of graduating without student loans.

Here are some tips for getting great exam scores:

Pick one test to focus on.

What many students don’t realize is that no colleges require a test score from BOTH the SAT and ACT. They will only require one or the other. Now, some college prep bloggers would advise that you take both exams because you never know which one you may naturally score better on. And there is some wisdom in this approach. However, I would recommend investigating the key differences between the two and preparing solely for one or the other.

Prepscholar does a great job comparing and contrasting the exams, but here are three quick facts to consider:

- The SAT gives you a little more time per question than the ACT.

- The math section of the SAT counts for 50% of your overall score, whereas with the ACT it only accounts for 25%.

- The ACT includes a dedicated science section (which again accounts for 25% of your score). The SAT does not.

Right off the bat, you may be thinking to yourself that one exam appeals to you more than the other, based off of your own strengths and weaknesses. Great. Now you must decide on your preparation strategy.

Prepare for the test.

For sake of illustration, let’s say you decided that you wanted to focus on the SAT exam. I would highly recommend finding a prep class to participate in during the summer break between your sophomore and junior years of high school, or during the beginning of the fall semester of your junior year. Just google “SAT prep classes near me,” and I guarantee you’ll be able to find classes that are being held in your area.

If you decide against enrolling in a course, then I would definitely recommend buying the official study guide on Amazon (We receive commissions when you purchase Amazon products via our links. Thank you for your support.) and then taking some practice tests online.

Decide when to take the test.

Using the SAT as an example again, the test is offered at 7 different times throughout the year: August, October, November, December, March, May, and June. My recommendation would be to:

-

- Take the test in the fall of your junior year

- Take it again in the spring of your junior year.

- Optional: You could take it one more time in the fall of your senior year, but just know that it is unlikely that your test score would rise significantly after 2 attempts.

4. Test Out of Courses

The College Board (the same organization who administers the SAT exam) also offers a program referred to as CLEP (College Level Examination Program), whereby students can receive credit for over 33 introductory courses simply by passing a CLEP exam. Each exam only costs $87, easily less than 10% of the typical cost of a course. CLEP even offers a study guide (We receive commissions when you purchase Amazon products via our links. Thank you for your support.) to help prepare you for the exam.

But what I’m most excited about, is a new program that CLEP just launched in collaboration with Modern States, called “Freshman Year for Free.” Incredibly, this program:

-

-

- Offers FREE high-quality courses taught by top universities to help prepare you for whichever CLEP exam you intend to take

- Will even pay for your CLEP exam fee (for the first 10,000 students to register for courses with this program)

-

You could literally earn college credit completely FREE with this program.

Modern States’ primary goal would be for students to prepare and pass 8 CLEP exams and, in essence, go to school their Freshman year for free – with no tuition or textbook expenses whatsoever. This could give many students a head start towards their goal of graduating without student loans. For information about this program, check out their website.

5. Fill Out Your FAFSA

The FAFSA (Free Application for Student Aid) should definitely be your starting place when it comes to trying to find college financial assistance. Not only is a filled-out FAFSA required for federal student aid, but many public and private institutions use the FAFSA to determine which students should receive their own grants.

Students with lower incomes may be eligible to receive the Pell Grant. The maximum amount of Pell Grant money student can receive changes every year, but for 2017-2018 the total was $5,920. Unlike Stafford Loans, this is NOT money that has to be repaid and can be used at any public or private institution. But many students miss out on this amazing opportunity simply because they didn’t fill out their FAFSA.

Nerdwallet found in 2016 that students missed out on $2.7 billion worth of student aid just because they didn’t fill out their FAFSA! Don’t be one of the ones who make this mistake!

6. Apply for State-Specific Grants

In addition to federal funding that can be secured via the FAFSA, many states have their own set of education grants set in place. Some states are more generous than others and each will have different steps that you will be required to take to apply and receive them.

Here, in Florida, for instance, we have two primary grants/scholarships that many students can qualify for. One is a Florida-residency grant (The ABLE Grant), and the other (Bright Futures) is based on achievement – high school GPA and SAT/ACT exam scores. For the Bright Futures scholarship, however, students must fill out a separate financial application that is specific to Florida (The FFAA) in addition to the FAFSA.

To research what your state has to offer, and what the application process looks like, I would begin by googling your state’s name followed by “Financial Aid.” So, in my case, the search query would be: “Florida Financial Aid.” This should start you off in the right direction. You might be surprised to find what your state has to offer!

7. Take Your Scholarship Search Seriously

Many students are skeptical about their odds of winning free scholarship money, so they approach their scholarship search with a ho-hum attitude. But with the right attitude, determination, and strategy, you can utilize scholarships to take thousands off your school tuition.

I’m not talking about mindlessly filling out application after application for random scholarship “sweepstakes.” I’m talking about a purposeful plan that gets results.

If you want to run laps around your peers when it comes to winning scholarships, check out our scholarship guide to learn 5 simple ways to double your scholarship earnings potential.

8. Go to Community and State Colleges

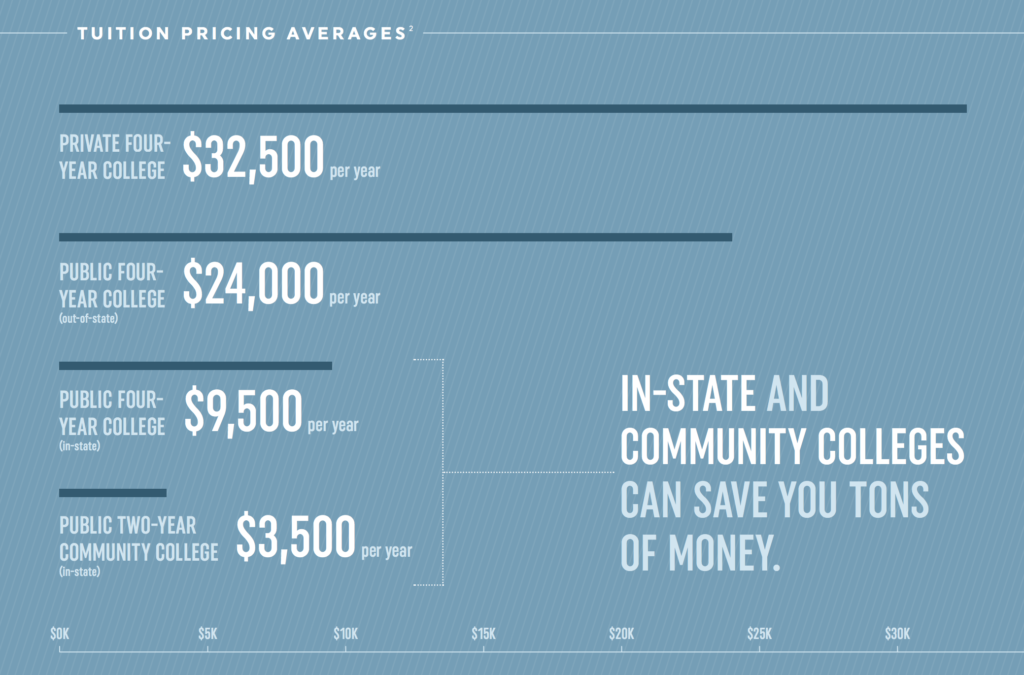

The infographic below is taken from Anthony Oneal and Rachel Cruze’s book The Graduate Survival Guide (We receive commissions when you purchase Amazon products via our links. Thank you for your support.). It compares the average tuition cost per year of different types of schools.

These numbers are truly startling! Knowing what I know now, I so wish I would have gone to a public university instead of private. I would have graduated with soooo much more money in the bank.

Listen, I know you may have a “dream” school that you’ve always hoped to attend after high school. But I’ve got an even better dream for you to fantasize about:

Graduating Without Student Loans!

It could literally change the whole course of your life. The truth of the matter is that for the vast majority of career choices, your future employer will care ZERO about the name of the school you graduated from. The degree is the part that hiring managers care about (because it shows them that you have a good work ethic and can complete something that you start) NOT how much the degree cost you.

I would highly recommend that you start out your first 2 years at a community college near you, and then finish your last 2 years (or more) of school at a state school. Yes, your cool factor may be knocked down a couple of notches with some of your friends.

But fast-forward 6 years and imagine yourself completing the purchase of your first home, while a lot of those same friends are back living in their parent’s basements until they can get out of debt.

Who’s cool, now?

9. Keep Working in College

I realize that it would be enjoyable to spend your college years completely immersed in the college culture and being able to focus wholly on your coursework. However, if you’re like me, you may not be able to afford this luxury. I worked 30 hours a week throughout the entirety of my college years.

Is it tough to juggle everything? Yes. Were there countless nights that I fell asleep while writing a paper? Yes. Were there times that I felt completely overwhelmed. Absolutely.

But on the other hand, because I had so much going on during my college years, I had to learn how to juggle more than one thing at a time, and I had to become proficient at time management – two skills that come in quite handy when you reach the workforce.

And after graduating without student loans, I was able to put the income from my new career immediately towards my financial goals instead of towards student loan debt, which made it all worth the sacrifices!

Need inspiration finding jobs that won’t conflict with your college schedule? Check out these 25 Amazing College Side Hustles.

10. Seek Out Employer Reimbursement

If you’re going to take my advice from above and get a job during college, why not double your effectiveness by working for a company that will reimburse your education expenses? Now that’s smart!

There are actually many companies that offer tuition reimbursement. In fact, here’s a list of TWENTY-THREE of them from the Krazy Koupon Lady, including Starbucks which will fully reimburse their employees’ entire bachelor’s degrees! Unless there’s a specific job you can get during college that would significantly help to prepare you for your future career, your job hunt should begin with these companies.

11. Don’t Overpay for Books and Technology

Remember when one of the most exciting times of the year was getting to go to Wal-Mart with our parents and buy our school supplies for the new school year? We all wanted to have the nicest stuff for two reasons: (1) Because we thought it would somehow make us “smarter,” and (2) because we wanted to impress our classmates.

Well, guess what? We’re all just overgrown kids, and it can be easy for us to have the exact same mindset towards purchasing our college supplies – only we’re talking about computers and textbooks here, not crayons and scissors. And with those kinds of purchases, when you buy more than what you really need it can cost you a lot of money.

Computers

While you may think that you will certainly not be able to survive as a college student without the latest MacBook that Apple has to offer, the reality is that’s most likely not true. Unless you are planning to be a graphic arts designer or a video producer, you will no doubt be able to be just as productive with a Windows machine that costs half as much.

And if you really want to go crazy about saving money on your school tech, Chromebooks, could also be a viable option. They are usually 25-50% even cheaper than Windows laptops. Five years ago when I bought my first Chromebook, it would have seemed silly to think that anyone would recommend buying a Chromebook for a college student. But the platform (and online software as a whole) has come a LONG way since then.

My brother just graduated in December (also without student loans), and he used a Chromebook for the entirety of his college career. Read his guide to surviving college with a Chromebook as your primary computer.

Textbooks

Let’s face it. No matter how you slice it, textbooks are expensive. But there are some strategies you can take to cut back on how much they will hurt your wallet:

- Don’t buy from your college. They will nearly always be charging a premium. Buy online instead. One exception to this: some colleges will match any online price you can find. Check your school’s policy to see if this is something they do.

- Buy used. If you are ok with some marks and highlights in your textbook, it could save you a ton of money.

- Buy an older edition. Do a little research online to find out how big of a difference there is between the current and previous editions. Oftentimes, the updates amount to little more than some page shuffling, and you could easily get along fine with the older edition…and save a lot of money doing so!

- Rent the book. This wasn’t an option when I was in school (at least not to my knowledge), but it has quickly become very popular. Several websites are dedicated to helping find textbooks to rent, and Amazon has gotten heavily involved in this space as well. My brother has rented a few of his textbooks on Amazon.

- Buy the e-book version. eBook versions of textbooks can sometimes save you a lot of money. Unfortunately, many people say that they hate reading from a screen and prefer having a hard copy of their reading materials. I used to say the same thing, but after trying one eBook, I was surprised to find that I got used to it very quickly. I also love the facts that (1) my eBook is with me anytime my phone or laptop is with me, and (2) I can’t lose it. If you’re a forgetful, absent-minded person like me, these are two huge pros!

12. Live With Your Parents

Here comes the confession. I lived with my parents during college.

I realize that many of you may be immediately thinking, “That’s so lame! I want to have an awesome dorm experience when I go to college!”

Well, if you can afford that experience without going into debt, then that’s great. But if you can’t, then going to a college that is close enough to your hometown that you could continue to live at home, could save you a lot of money.

In our home, our parents had a deal with me and my two brothers. We would have to pay for our college tuition completely out of our own pockets; BUT as long as we were in school, we could have free room and board. The second we either graduated or decided to quit school, we would have to go get our own place. This is how our parents helped us with college, and I greatly appreciate them for doing this, because it played a role in my graduating without student loans. Perhaps you and your parents could work out a similar arrangement.

13. Go to Night School

Since I’ve decided to dive into this whole confession thing, here comes another one. I was a night school student.

For some reason, “night school” tends to have a negative connotation that causes the hair on the back of people’s neck to bristle. But it can be a great option if you are someone who wants to be able to work 30 or 40 hours a week while you are in school.

Also, most night programs offer accelerated 6 or 8-week courses that only require you to go to class once a week. This was the way my program worked. I would work every day and then a couple of nights out of the week I would drive to Orlando for class. I personally loved the accelerated format, because I felt like it was a better use of my time.

Did I miss out on some “cool” college-campus stuff? Probably. But in general, I tried to make my decisions during college based off of what would set me up long-term to have a cool adult life, not necessarily a cool college life. Always remember that effectiveness beats ego every time,

Always remember that effectiveness beats ego every time.

14. Make a Budget

Compared to all of the other tips in this article, I know this last one seems rather boring. But the truth of the matter is no matter how much money you save on college, you still won’t find yourself graduating without student loans if you don’t learn to be a disciplined spender. I realize that in college your income may be more limited than it will be when you start your career, but I would still highly encourage you to get in the habit of building out a monthly budget. Even if you don’t have any other expenses than food or gas, go ahead and start budgeting how much you want to spend each month in these areas and stick to it. The exercise will not only benefit you now but throughout your entire life.

Conclusion:

So there you have it – the Complete Guide to Graduating Without Student Loans. It will take more work and resourcefulness than the average student, but graduating debt-free is not an “average-student” type of thing. The purpose of this article is to empower you to go against the student loan flow and take action. Because, deep down, I truly believe one thing: