1. Unison Allows You To Access Your Home’s Equity Without Taking Out a Loan

Ok, so if that headline confuses you, you’re not alone. I was confused as well.

But after spending hours researching how Unison works (and asking a ton of questions to the rep that we worked with) I’ll do my best to explain their business model clearly and concisely.

Unison is willing to give you up to 15% of your home’s value in cash in exchange for a percentage of your home’s future value when you sell.

Let’s say your home is worth $200,000. In that case, Unison would be willing to enter into an equity sharing agreement (not a loan) on your property of up to $30,000 (15% of $200,000). Get a quote from Unison.

2. Unison Shares in the Future Growth or Depreciation of Your Home’s Value.

Unison’s percentage in your home’s future sale value is dependent on the size of your equity sharing agreement.

If you take out a smaller agreement, Unison takes a smaller percentage. The larger the agreement, the larger the percentage of your home’s future value that Unison will take. Unison’s minimum sharing percentage is 20% and their maximum is 70%.

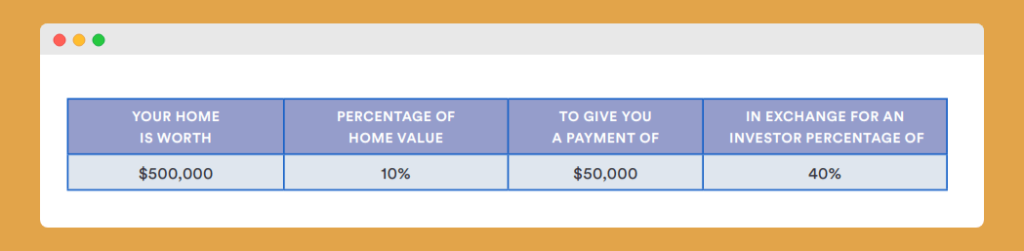

It’s important to understand that Unison will share in your property’s growth or loss. Let’s take a look at an example from Unison’s Program Guide. In the example below, Unison gives you $50,000 in exchange for a 40% percentage in your home’s future value.

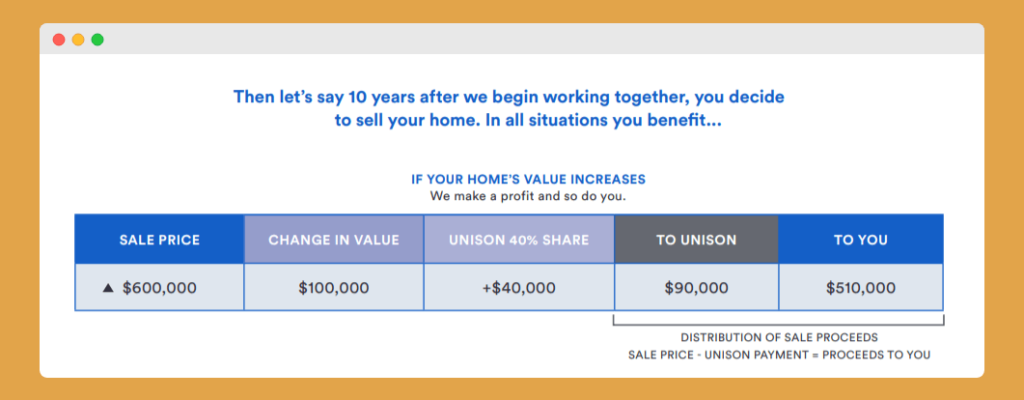

Let’s say that 10 years later, you sell your home for $600,000. In that case, you make a profit and so does Unison. They receive their initial $50,000 back, plus $40,000 from your home’s $100,000 value increase. In total, you pay Unison $90,000 after you sell your home.

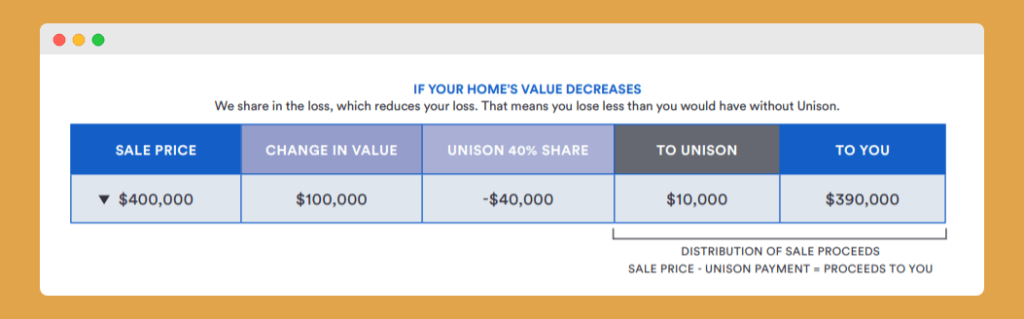

But let’s say that your home actually decreases in value to $400,000. In that case, Unison would take a 40% share in the loss as well. Instead of paying them back the full $50,000 after you sell your home, you’d only pay $10,000.

So you’d actually lose less than you would have if you hadn’t partnered with Unison. It’s important to point out, though, that Unison will not share in the loss of your home if you sell within 3-5 years of your initial agreement.

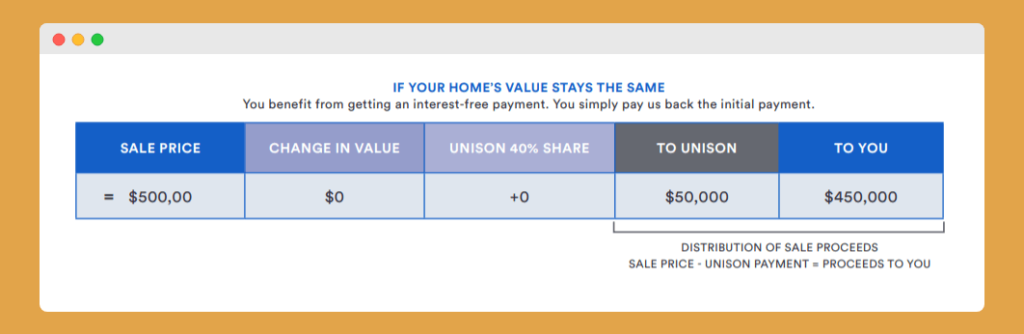

Finally, one last example. Let’s say that you sell your house for exactly the same amount as it was worth when Unison partnered with you. In that case, you’d simply owe Unison the $50,000 that you were initially given. So you would have basically had a 10, 20 or 30-year interest-free loan.

3. Unison Agreements Come With No Monthly Payments.

The fact that Unison will also share in the future loss of your home makes them radically different from a home equity loan. Another difference between Unison and home equity loans is that you don’t have to make any monthly payments to Unison.

At risk of sounding like a broken record, let me say this again. The money you receive is an equity sharing agreement, not a loan. You don’t have to pay a dime until you sell your home or until 30 years have gone by. Get started with Unison.

What’s the Catch?

That’s the question that I kept asking myself. So I decided to read a few other Unison reviews to see if could figure out what I was missing.

The answer? There isn’t a catch in the technical sense of the word. Unison is legit. They’re not a fake company or a scam.

But many writers and opinionists are pretty negative about Unison for one major reason.

You’ll probably end up paying Unison more than you’d pay for a traditional home equity loan.

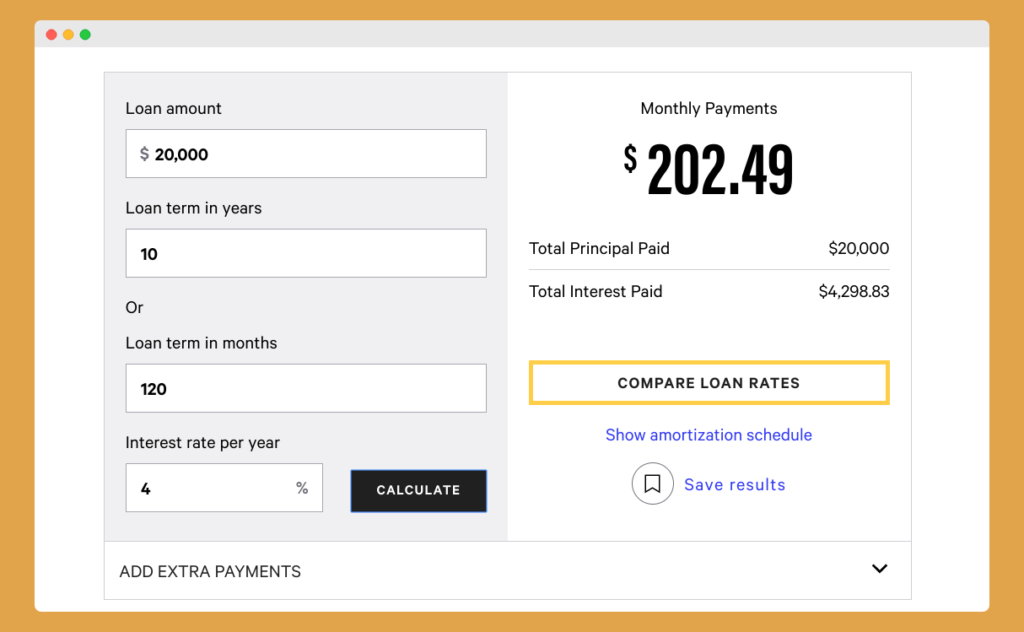

Here’s why. Let’s say you took out a $20,000 home equity loan at a 4% interest rate that you pay back over a 10-year period.

In that situation, you’d end up paying a total of $4,298.23 in interest for a total cost of $24,298.23.

However, let’s say that your home grew by $100,000 during that same 10-year period (which is totally feasible) and you owed Unison 50% of that growth.

In that situation, you’d owe Unison an extra $50,000 from your home’s growth for a total cost of $70,000.

That’s a huge difference! So, when you look at it that way, it seems like a home equity loan is the slam dunk better choice. But it’s actually even worse than that. Unison charges a 3.9% transaction fee that is deducted from your loan total.

So in my case, while the amount of equity we accessed from Unison was $25,000, we only actually received $24,025 in cash because they took $975 right off the top.

So, after explaining all that, why in the world would I choose to use Unison to access some of our home’s equity?

Let me explain my thinking process.

Why I Chose Unison

So why would the finance nerd go with something that seems like such a bad deal from a math perspective? Before you start yelling at me for being a fraud, let me give my best shot at defending myself.

1. I already had a lot of equity in my home.

My wife and I bought our home for $90,000. But in the last five years since we bought our home, our area’s home market had experienced what I thought was a huge run-up.

By the time that we were considering a Unison agreement, our home’s appraised value had increased (in only four years) to over $175,000.

So we already had $85,000 of equity that was ours no matter what. And I knew that the only way we’d pay more than $25,000 back to Unison would be if I sold my house for an even bigger profit than I already had locked in. And I was ok with that tradeoff.

However, I would not recommend Unison for someone who doesn’t have much equity in their home yet. If our home’s appraised value last year had only been $100,000, for instance, I absolutely would not have gone through with a Unison agreement.

2. I value having no monthly debt obligations other than my mortgage.

I’m a huge cash-flow person. We currently have no debt in our life other than our home and I love that.

If we have an emergency pop up this month, I can easily cut back on “want” budget items like travel and out-to-eat. But you can’t cut a car payment or home equity loan payment out of your budget.

As I’ll talk about in just a moment, the whole reason for wanting to access our home’s equity was to use it towards an investment property.

But what if things changed (and they did) and I wasn’t able to buy a rental property as soon as I hoped? With a home equity loan, I’d still have that monthly payment. But with a Unison agrement, I’d still have complete financial freedom.

Do I fully realize that Unison may get more money out of me than I’d pay a home equity lender? Yes.

But I’m ok with that. Freedom is worth that to me. Check out Unison.

3. I planned to invest the money.

Ok, so this is the biggie.

Whether we’re talking about a Unison agreement or a home equity loan, I would never recommend accessing your home’s equity to pay for a dream vacation or buy a car. As usual, I’d advise you to save up and pay for those things with cash.

However, getting cash from Unison can make sense if you plan to invest the cash for a long-term benefit. In fact, Unison strongly recommends that you only use their cash for such a purpose.

Of the ideas that Unison mentions for how to use your money, my three favorites are remodeling your home, making a down payment on a rental property, and starting a business.

For example, if you use your Unison cash to fund a home remodel, it could help you sell your house for a lot more on the market. In our case, we wanted to buy a rental property. Our goal was to buy a home or townhome for less than $100,000 and use the funds from Unison to put at least 20% down.

The Math

Here’s how the math would work out.

We buy a $100,000 house with our Unison funds. Then we begin receiving ~$1,500 monthly rent payments ($18,000 a year of income) PLUS we keep 100% of the rental property’s market appreciation whenever we sell.

In this way, the $25,000 from Unison could easily turn into over $200,000 of income over a 10-year period. That’s the math that I was focusing on.

One more thing. You don’t have to wait till you sell your home to pay Unison back. You can buy them out after 3-5 years. You just have to pay them back including their equity sharing percentage of your home’s current appraised value.

If our rental property did well, I’d consider buying Unison out early. That way I’d enjoy 100% of the market appreciation of both properties moving forward.

2024 Update: Do I Have Any Regrets of Choosing Unison?

So what you just read above was my “plan.” But sometimes life changes.

In my case, there were two pretty huge changes. First, I began pursuing a new career in writing. We took out the Unison agreement right before I made the decision to heavily pursue this new career path.

With the uncertainty of a new self-employed career on the horizon, I didn’t feel comfortable with taking on the debt obligation of a rental property. And once I became a full-time freelance writer, I needed at least 18 months of income history before I could qualify for a mortgage. So basically, the planning guy did an absolutely awful job of planning on that front.

Second (and this one I couldn’t possibly have planned for), the pandemic happened in 2020 and then the housing market went absolutely crazy. In case you’ve been living under a rock, here’s a chart that shows how fact prices have skyrocketed over the past few years.

The Downside

What does this mean for me? Where I live in Florida, my home’s value has likely increased by about another $100,000 since 2020. That’s a turn of events that I simply could have never anticipated when I entered my Unison agreement in 2018. If anything, I thought that my area’s home market was overdue for a cooling off period back then. Wow, was I wrong.

It’s true that the market has retreated a bit since its mid-2022 peak thanks to higher interest rates. But I, for one, don’t foresee a 2008-level home recession on the horizon (especially in Florida which is currently experiencing a population surge). So if, and when, we do sell our home, Unison is going to be getting a much fatter check from me after closing than I ever envisioned — in fact it makes me rather queezy to think about.

As a side note, I should also mention that one unexpected outcome of entering an agreement with Unison has been that it’s created a strange conflict of interest in me as a homeowner. I find myself disappointed in news that the market is appreciating and excited when I hear that prices are decreasing. That’s an odd feeling to have when you own an asset of any kind; and I don’t like it.

The Upside

I’ve still participated in this market run-up. For every dollar that my house appreciates over $175,000, I get to keep about half of that equity.

I haven’t lost any actual dollars in my bank account as a result of these pandemic-fueled price hikes. And I still haven’t lost a penny of the initial equity that I had built up before entering into my agreement with Unison. The “bad news” is really all related to how much profit we get to keep after we sell our home.

For example, if we sold our house for $275,000, we’d end up paying about $50,000 to Unison in shared equity in addition to paying back the $25,000 received – so $75,000 in total. Does that extra $50,000 hurt? Yes. But in this case, we’d still end up pocketing around $200,000 ourselves based on the principal balance that we have left on our mortgage.

Is Applying With Unison a Good Idea in 2024?

Despite my own personal experience with (in a sense) getting burned by using Unison, I actually think that it could make sense for a specific set of homeowners today. And who would those ideal homeowners be? Those who bought their homes prior to 2020.

Here’s why.

- If you bought your home prior to the pandemic, you’re likely sitting on a ton of home equity right now.

- Virtually every real estate expert is predicting that the housing market will stay relatively flat over the next few years. This is due not only to interest rate pressure but also to the fact that home price appreciation has far outpaced income growth since 2020. Home affordability is at a record low so natural market dynamics point towards the necessity of a slowdown.

Combine these points together and you’ll find this might actually be one of the most opportune times in history to use a service like Unison. You have lots of equity at your disposal and your chances of the market running away from you (like it did for me) are at a historical low.

Still, it’s important to point out, that nothing is guaranteed. If 2020 showed us anything, it’s that the home market (and stock market for that matter) are unpredictable. So while the odds might be in your favor, you shouldn’t apply with Unison unless you’re ok with, a few years from now, facing a similar situation to what I’m facing today.

Who Should Definitely Not Apply With Unison?

As mentioned earlier, I wouldn’t recommend applying with Unison if you don’t have much equity built up in your home yet. I only like the idea of using Unison for homeowners who already have a significant amount of equity locked in that they can’t lose.

Second, I wouldn’t take out a Unison agreement unless you have a legitimate plan for the money (i.e. investing, debt reduction, renovate your home, etc). And, third, I’d stay away from Unison if you plan to stay in your current home longer than 5 years. Over that period of time, it’s highly unlikely that the market won’t have gone up at least some and potentially a lot.

“But wait,” you say, “If I don’t stay in my home at least 5 years, then I won’t have the option of Unison sharing in any losses.” That’s correct. But there’s a reason that Unison includes that 3-5 year restriction. It pretty much guarantees that they’ll never have to share in any losses.

In my opinion, the quick you can terminate your agreement with Unison, the better. Remember, you can do so at any time by selling your home. So Unison could be ideal if you’re planning to move in a few years. But if you don’t want to leave your current home, you’ll need to wait at least the 3-5 years before you can buy Unison out.

Conclusion:

Unison is a unique company. Are they out to make money? Absolutely!

But so are home equity lenders. Yet with Unison I can use their cash towards an investment opportunity and receive years of return before paying them a cent. For me, that was a worthy tradeoff.

Unison isn’t right for everybody. But, as someone who’s personally used them, I can tell you that they are legit. And if you’re looking for ways to access your home’s equity for an investment, they totally deserve your consideration. Get started with Unison here.

Unison Review

-

Payment Flexibility

-

Fees

-

Customer Service

-

Availability

-

Long-Term Cost

Summary

Unison will give you cash in exchange for a percentage of your home’s future value when you sell. Since Unison agreements aren’t loans, there are no monthly payments requirements and any deal you receive from them won’t affect your credit score. However, in the end, you could pay significantly more to settle your agreement with Unison than it would cost you to pay off a HELOC or personal loan.

Awesome article, thanks so much for breaking it down for me!

Sure thing! Thanks for reading!