If you have federal student loans, you could be eligible for an income-driven repayment plan. And income-driven repayment could make your monthly student loan payment more manageable and improve your cash flow.

Plus, once you’ve completed your repayment schedule on an income-driven repayment plan, the remaining balance will be forgiven. Speaking of forgiveness, you’ll need to be on an income-driven repayment plan in order to qualify for Public Service Loan Forgiveness (PSLF).

But income-driven repayment isn’t right for everyone. It has its share of pros and cons. This guide will cover everything you need to know about income-driven repayment so that you can decide if it’s the right decision for you.

1. How Are Payments Calculated on Income-Driven Repayment Plans?

There are four main income-driven repayment plans.

- IBR: Income-Based Repayment

- ICR: Income-Contingent Repayment Plan

- REPAYE: Revised Pay As You Earn

- PAYE: Pay As You Earn

Here’s how your monthly payment is calculated under each plan.

| Income-Driven Repayment Plan | Monthly Payment |

|---|---|

| REPAYE Plan | Generally 10% of your discretionary income. |

| PAYE Plan | Generally 10% of your discretionary income, but never more than the 10-year Standard Repayment Plan amount |

| IBR Plan | Generally 10% of your discretionary income if you’re a new borrower on or after July 1, 2014*, but never more than the 10-year Standard Repayment Plan amount

Generally 15% of your discretionary income if you’re not a new borrower on or after July 1, 2014, but never more than the 10-year Standard Repayment Plan amount |

| ICR Plan | The lesser of the following:

|

Still a bit confused? Yeah, I don’t blame you.

In order for the above table to make any sense, you need to understand what exactly the term “discretionary income” means.

How to Determine Your Discretionary Income

For federal student loans, your discretionary income is whatever money you bring in that’s over 150% of the federal poverty guidelines.

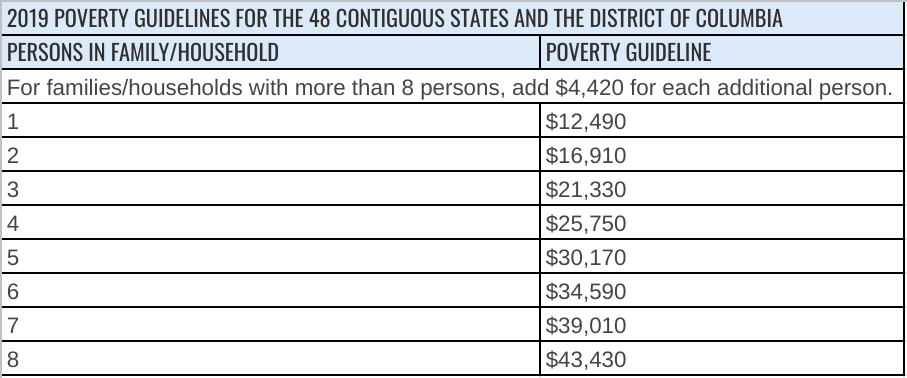

Here is a quick table that shows the federal poverty guidelines for 2019.

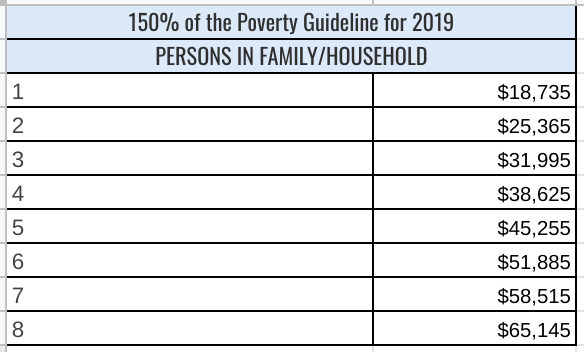

Remember, to determine a family’s student loan repayment discretionary income, you need to take the numbers listed above and multiply them by 150%.

I’ve gone ahead and made those calculations for you and they’re listed below.

This means that for a family of one, your discretionary income is any income that you bring in over $18,735. So, if you have a $35,000 annual income, you would subtract $18,735 from that number, making your discretionary income $16,265.

For most of the income-driven repayment plans, you would then owe 10% annually on that number. So your annual repayment amount would be $1,626 ($16,265 x .10) and your monthly payment would be around $135 ($1,626/12).

If you made less than $35,000 per year, your payment would be smaller. If you had a larger family, your payment would be smaller as well.

On the other hand, as you make more money or your family gets smaller, your payment will go up.

But what if you make less money than the discretionary income floor for your family size? Then your monthly payment would be $0.

That’s right — $0.

For example, if you have a family of 4 and you make less than $38,625 this year, you would have no monthly student loan payment on any of the income-driven repayment plans.

2. How Long Do You Have to Pay Before You’re Eligible for Forgiveness?

Here’s how many years you’ll need to make payments on each plan before the remaining balance can be forgiven.

| Income-Driven Repayment Plan | Repayment Period |

|---|---|

| REPAYE Plan | 20 years if all loans you’re repaying under the plan were received for undergraduate study

25 years if any loans you’re repaying under the plan were received for graduate or professional study |

| PAYE Plan | 20 years |

| IBR Plan | 20 years if you’re a new borrower on or after July 1, 2014

25 years if you’re not a new borrower on or after July 1, 2014 |

| ICR Plan | 25 years |

So with each of these plans, the earliest that you’re looking at being rid of your student loans is 20 years.

If the thought of that doesn’t sound appealing to you, you may want to stick with the Standard Repayment Plan and try to pay off your student loans as soon as possible.

3. What are the Eligibility Rules for Income-Driven Repayment Plans?

If you’re interested in applying for an income-driven repayment plan, you’ll need to make sure that you have eligible federal student loans.

Don’t worry, most loans are eligible right off the bat. A few loans, however, like Parent PLUS loans and FFEL loans, need to be consolidated before they can become eligible for income-driven repayment.

It’s also important to note that, even after consolidation, Parent PLUS loans are only eligible for the ICR (Income-Contingent Repayment) Plan.

Income Rules

Anyone, regardless of income, can make payments under the REPAYE and ICR plans.

But in order to qualify for PAYE or IBR, the payment that you would make must be less than what you would pay under the Standard Repayment Plan with a 10-year repayment period.

What this means is that if you have a high income, you may not be eligible for PAYE or IBR. But if your federal student loan debt is higher than your annual discretionary income or represents a major portion of your annual income, you should qualify.

It’s also important to note that once you’re on PAYE or IBR, you can’t be kicked off. Even if your income goes up and your payment becomes equal to what it would be on the Standard Repayment Plan, you can still make your payments under the PAYE or IBR income-driven repayment plans.

This is important if you’re working towards Public Service Loan Forgiveness (PSLF). If that’s you, you’ll want to stay on your income-driven repayment plan no matter what, so that you can be eligible for forgiveness in 10 years.

PAYE Rules

The PAYE plan has its own set of eligibility requirements that you’ll need to meet if that’s the plan you want to choose.

You’ll need to be considered a “new borrower.” Here’s how the Department of Education defines that:

- You took out federal student loans after Oct. 1, 2007.

- You didn’t have a federal student loan balance when taking out those loans.

- You received a Direct Loan on or after Oct. 1, 2011.

In layman’s terms, if you went to school in or after 2007, you should be eligible for PAYE.

4. How Do You Apply for an Income-Driven Repayment Plan?

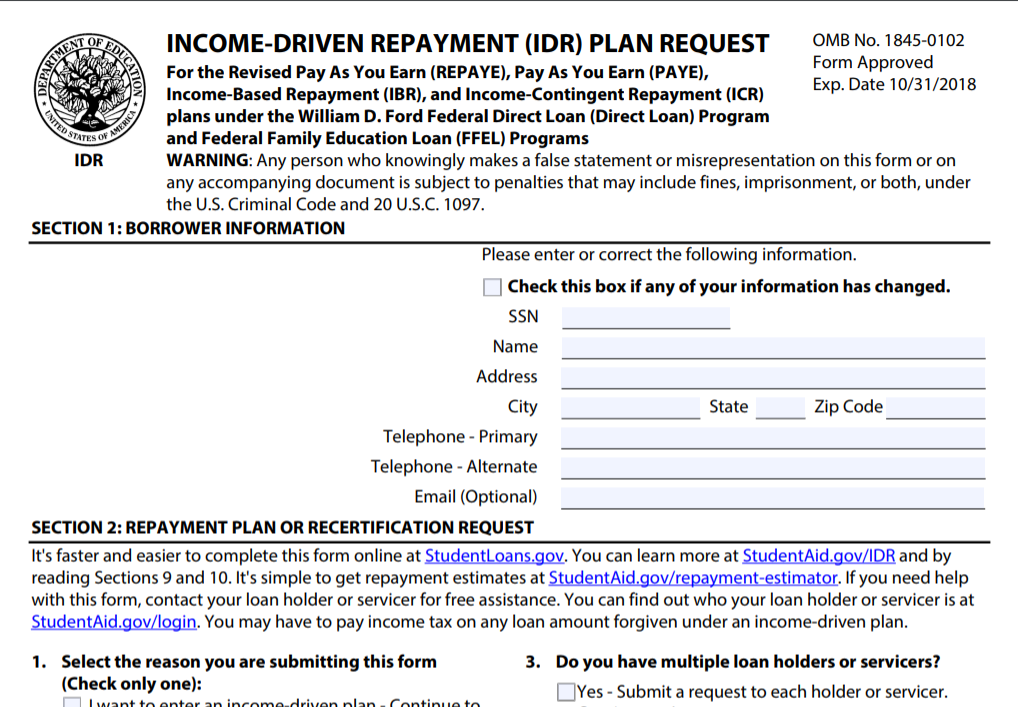

If you want to apply for income-driven repayment, you’ll need to submit an application called the Income-Driven Repayment Plan Request.

You can also complete this form online, and I would recommend doing so.

When you submit your application, you’ll be asked some questions about your income. It’s important to understand that you need to put down your income from last year, not what you expect to make this year.

This is very important for new graduates. If you were a full-time student last year, then you very likely brought in little to no income last year. This is what you’ll want to put down on your application.

If you do this, your estimated first payment will most likely be $0.

This will give you several months to find a job. Then, the following year, when you recertify your income, you’ll start making payments.

Speaking of recertifying your income, let’s discuss that now.

Recertifying Your Income and Family Size

In order to stay on your income-driven repayment plan, you’ll need to recertify your income and family size each and every year.

Your student loan servicer should remind you about recertifying well in advance of the deadline. To recertify, you’ll simply need to submit another income-driven repayment plan application.

You’ll want to recertify as soon as you receive your reminder! I can’t stress this enough!

If you forget to recertify or miss the deadline, you will be kicked off your income-driven repayment plan. Not only will your payment most likely rise significantly, but any unpaid interest that you’ve accumulated will capitalize.

Make sure that you recertify with plenty of time to spare each and every year.

5. What are the Downsides of Income-Driven Repayment?

There are a few downsides of income-driven repayment that you need to be aware of.

You’ll owe taxes on the forgiven amount.

If your income stays relatively low throughout your entire repayment period, you’ll most likely have a hefty balance left unpaid at the end.

- The good news is that the federal government will forgive all of those loans.

- The bad news is that the forgiven balance will be taxed as income.

Depending on your income level at the time you receive forgiveness, you could be taxed anywhere from 10-35% on your forgiven balance.

So, if you had $50,000 of student loans forgiven and an income tax bracket of 24%, you’d owe the government $12,000. This is often referred to as the student loan forgiveness “tax bomb.”

It’s important to understand that under the Public Service Loan Forgiveness program, the forgiven amounts are not treated as taxable income. This is one of its biggest perks.

But for income-driven repayment plan forgiveness, you will owe taxes on your forgiven balance. For this reason, I recommend that you save a little each year so that you’re prepared for the “tax bomb” when it hits.

You’ll Most Likely Pay More Overall.

Since income-driven repayment plans draw your repayment period out an extra 10-15 years, you will pay a ton of extra interest on your loans.

And often, you’ll pay more overall than you would have paid by sticking with the Standard Repayment Plan (yes, even with taking the forgiven amount into consideration).

BUT…in the meantime, your cash flow situation will be much better.

I think we all know that we’d pay a lot less for our homes if we paid cash for them up front instead of spreading out payments (with interest) over 30 years. But when you’re talking about a purchase that large, that’s often just not possible. And many students are graduating with student loans that are the size of small mortgages.

Would I prefer that you pay off your loans sooner and pay less interest? Absolutely.

But if an income-driven repayment plan will make it possible for you to pay your mortgage and keep the lights on, I’m certainly not going to be the one to judge.

6. Who Should Apply for Income-Driven Repayment?

A good rule of thumb is that if your student loans are at least twice the amount of your annual income, you should strongly consider an income-driven repayment plan. The overall strategy for people in this position is: “Pay as little as possible and save up for the tax bomb.”

However, if your student loan totals are less than two times your annual income, income-driven repayment may not benefit you as much. And if your student loan/annual income ratio is near 1:1, this could be especially true.

If you are in these situations, your best bet may be to pay your student loans down as fast as you can. You may even want to consider refinancing into a lower interest rate.

Conclusion:

If you’re wondering which income-driven repayment plan would be best for your situation, ask your student loan servicer. They “should“ be able to give you good information.

However, if you’re not getting the answers you’re looking for from your servicer customer service department, you may want to set up a consultation with my friends at Student Loan Planner. Travis Hornsby and his team have advised on over $600 million worth of student loans and they will give you solid, unbiased advice.

Feel free to reach out to me with questions as well. You can leave a comment below or email me at clint@walletwiseguy.com.

General FAQ

Income-Driven Repayment plans make your student loan payments more manageable by basing them on 10% of your discretionary income.

No. There is no credit score requirement to qualify for Income-Driven Repayment and there is no credit check.

Yes and no. They can improve your monthly cash flow situation, but you’ll often pay more in interest over the life of the loan.

No. But if your monthly payment on an IDR plan would be equal or more than your payments on the 10-Year Standard Repayment Plan, you will be ineligible to join.

Yes. Your remaining balance will generally be forgiven after 20 years.