Tally is a new smartphone app, obviously built with millennials in mind, to help you get rid of credit card debt. We’re all about paying off debt here at the Wallet Wise Guy, so let’s discuss how Tally works and whether or not it may be a good option for you.

The Problem

We, Americans are struggling mightily with credit card debt. The average household with credit card debt has a balance of $15,482. For those who don’t pay off their statement balances each month, known as “revolvers,” they carry on average a balance of $6,081. Using the national average interest rate of 14.87%, that’s an average of $904 in interest per household.

Additionally, because many households have multiple credit cards, it can be difficult to keep track of each card’s payment schedules. And when payments are late or missed, late fees and other charges get added to the pile, increasing the costs of credit cards even more.

Tally’s Solution

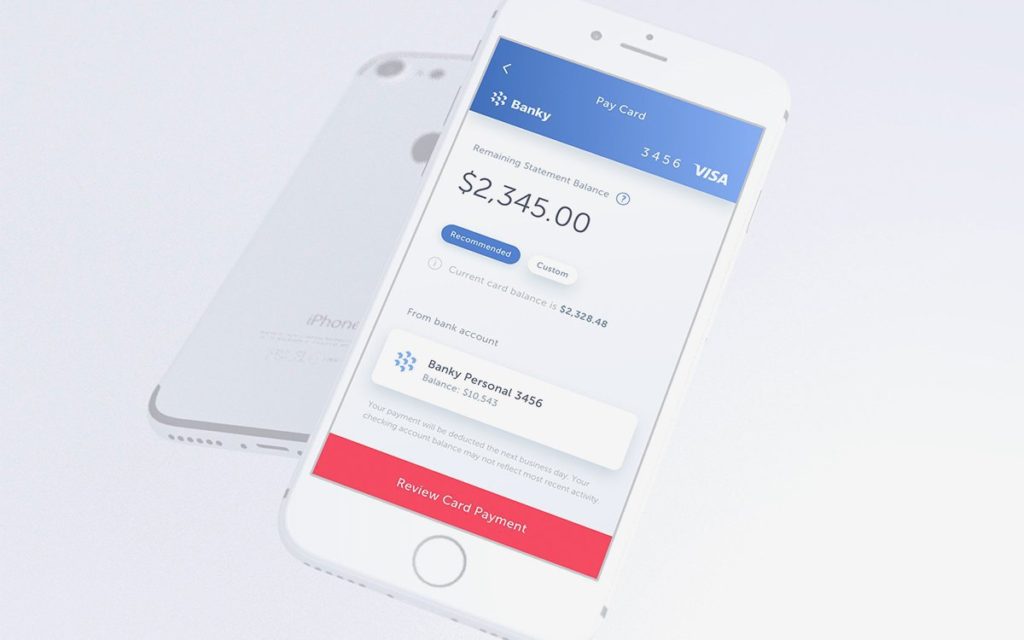

Tally claims that their goal is to help their customers get out of credit card debt, and they have a unique strategy for accomplishing this. Everything really revolves around their app. After you’ve downloaded it on your phone, you begin scanning in all your credit cards.

You also give your personal information to Tally so they can run your credit. If you have a high enough credit score, they will offer you a line of credit with a lower interest rate than the current combined rate of your credit cards. Customers with at least a 660 FICO credit score can qualify for a line of credit. However, to receive Tally’s best annual percentage rate, which is 7.9%, you’ll likely need a score over 720. Their highest rate, for customers with the lowest scores, is 19.9%.

Then, instead of worrying about all of your credit card payments, you make one payment a month to Tally, and Tally makes the payments to all of your credit cards. Additionally, they pay off your highest interest rate cards first and then work their way down. So essentially they create your debt snowball for you and make the payments for you as well.

They do make sure to stress that it’s the borrower’s job to make sure that Tally is able to keep an electronic connection with your credit card banks. In other words: “If we miss a payment due to a broken connection, it’s not our fault.”

Our Take on Tally: It Could Add More Complexity Than it Takes Away

Simplicity.

This is Tally’s main calling card. Use Tally and you won’t have to stress about keeping track off all your different credit cards, their minimum payment amount, and their due dates ever again.

But in my opinion, there are three…uhh…SIMPLER solutions if you are someone who feels like you are someone who is struggling with one of the problems listed below.

Problem 1: Interest Rates on Credit Cards are Too High

Simpler Solution: Apply for a 0% Balance Transfer Card

Tally rightfully realizes that there is a market for offering credit at lower interest rates. After all, if auto loans and mortgages are typically both offered below 5%, why should the shirt I buy at Target be charged at 21% interest?

Additionally, many consumers may have had a lower credit score when they first applied for their card, but now, after years of on-time payments, their score has sky-rocketed. Why shouldn’t they get an interest rate that reflects that?

So while I completely agree with the idea that consumers should try to lower their interest rate, you can accomplish this just as well by applying for a 0% balance transfer card. Here’s a list of the best ones on the market right now.

This would also accomplish the goal of combining all of your payments into one; plus, as an added bonus, you get to have 12-14 months with NO interest instead of an interest rate of 8-19%.

And you don’t have to worry about keeping all of your banks connected with a separate app. Sounds pretty simple, right?

Problem 2: Keeping Track of Several Different Credit Card Bills and Payment Dates Is Difficult

Simpler Solution: Set Up Credit Card Automatic Payments

Whenever I get accepted for a new credit card, setting up automatic payments is the very first thing I do. I know that I naturally tend towards being a forgetful airhead. That’s why I try to automate as much of my financial life as I can. I transfer money to my savings and retirement accounts each month automatically, and I pay my bills automatically as well.

When you have automatic payments in place on your credit cards, you don’t have to worry about missed payments and late fees. All you have to do is set it up one time, and then you’re good to go from that point forward.

And you don’t have to pay ANOTHER company 8-19% to do this for you.

That’s simpler.

Problem 3: Consumers Waste a Lot of Money in Interest by Paying Off Credit Cards in the Wrong Order

Simpler Solution: Create Your Own Debt Snowball

Tally’s “artificial intelligence” smarts that help you pay off your credit cards in the order that is most beneficial, really is…artificial. It doesn’t take much intelligence to set up a debt snowball. It’s actually really easy and anyone can do it in about 10 minutes. Hop on over here and build yours now. Once you’ve plugged in your numbers, it will tell you exactly which cards to focus on first, second, third, and so on.

It will even tell you what your payoff date will be, and how many months of payments you will eliminate by following the debt snowball program. Pretty simple, right!?

Conclusion

Don’t get me wrong: I don’t mean to come across as overly negative towards Tally. I think they have a real company, and I do think that their product will work as advertised. And if having an app like Tally would be exactly what YOU need to take control of your debt and get it out of your life, then, by all means, download it now and get to work!

Just remember, that no matter what app you use, the basics of debt reduction will always stay the same. You have to live off less than you make, and you have to make debt retirement a part of your monthly budget.