Worthy is a financial company that offers Worthy Bonds which are purchased in $10 increments and come with a 5% fixed interest rate. In case you’re thinking that was a typo, it’s not.

In our post COVID-19 world, the Fed rate is now 0% to 0.25% and the stock market has tumbled over 20%. So the idea that any saving or investment product could offer a 5% fixed annual return may seem too good to be true.

But Worthy Bonds is the real deal. They’re a legitimate company that has a solid business model. Intrigued? Keep reading our full Worthy Bonds review to learn more about what they have to offer.

UPDATE: Since the original posting of this article, a reader brought my attention to Worthy’s most recent SEC filings, which point out that they have yet to turn a profit as a company. While this not necessarily unusual for early-state startups, it’s also something that should gives savers extra pause before choosing to invest in Worthy Bonds. Based on this new information and considering that Worthy offers no form of insurance on its bonds, I do not recommend that savers put more than 10% of their emergency funds in them.

How Can Worthy Bonds Offer a 5% Fixed Interest Rate?

In the saving and investing world, less risk generally also means lower returns. For example, savings accounts are less risky than stocks since you get a guaranteed rate of return. But that return is also typically very modest. According to the FDIC, the average savings account rate is 0.07% and even high-yield accounts don’t typically offer rates above 2%.

The stock market, on the other hand, has averaged an annual return of about 7% throughout its history. That’s great. But in order to take advantage of that higher return, you must be willing to weather the short-term downturns in the market like we’re dealing with right now.

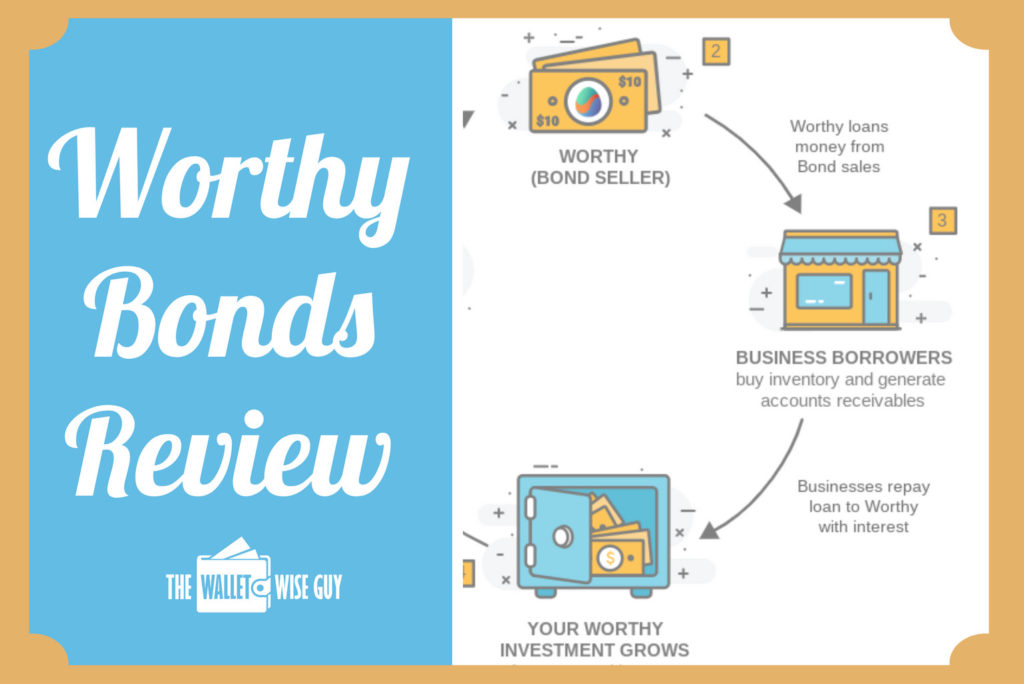

But Worthy is able to offer a higher return than savings accounts, while also offering a fixed rated. How are they able to do that? Because Worthy takes the bond proceeds and invests the money into secured, asset-backed small business loans.

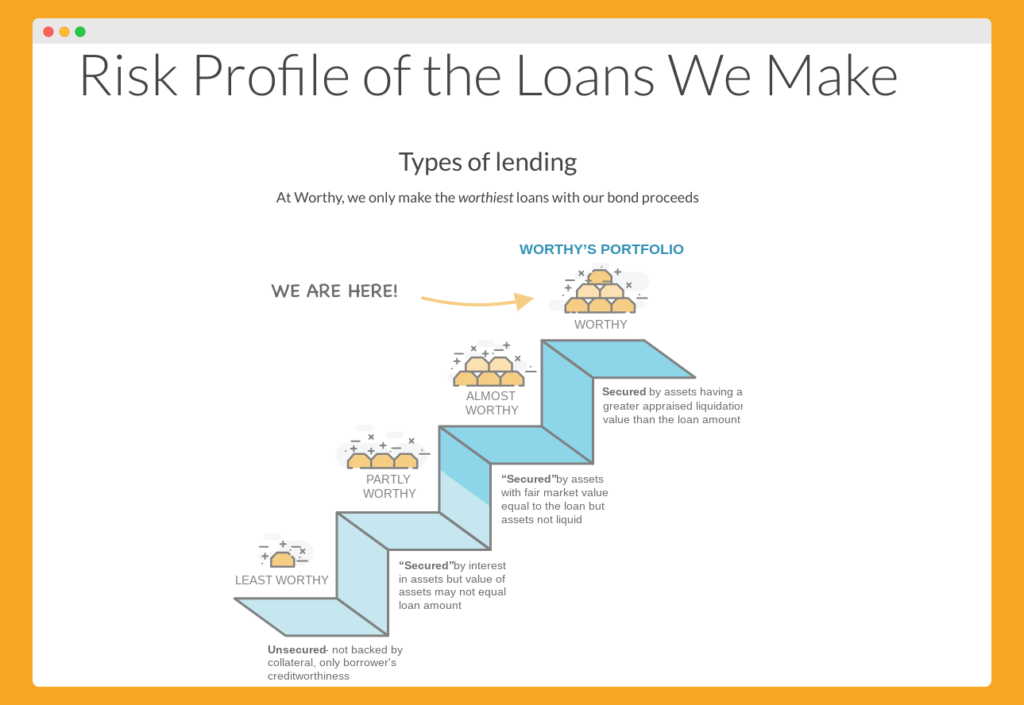

These loans are secured by assets that are equal or greater than the loan amount, which dramatically reduces Worthy’s risk. Additionally, Worthy is very careful about the loans they invest in (as shown in the image below). Worthy’s business model means that Fed rate changes have NO effect on the rates that they’re able to offer on their bonds. They say have no immediate plans to decrease their rate.

Do Worthy Bonds Come With Fees or Early Withdrawal Penalties?

Worthy’s bonds come with a 36-month terms. But here’s the great part — you can cash-out your bonds at any time without fee or penalty. And they don’t charge any other junk fees either like withdrawal fees, transfer fees, or reinvestment fees.

What Are Round-Ups?

Worthy also has a cool feature called “Round-Ups” that makes it easy to save money throughout the month and invest those savings in Worthy Bonds. To use Round-Ups, start by connecting your debit card or credit card to your Worthy Bonds account.

Worthy will then begin fetching your transactions and rounding them up to the nearest dollar. For example, if you bought a cheeseburger for $7.38, it would get rounded up to $8. So, in this case, 62 cents would be added to your “Round-Ups” total.

Once your Round-Up balance reaches $10, it will automatically trigger another bond purchase. Worthy transfers the funds from your connected bank account and purchases your bond as soon as the transfer clears.

What Are Worthy Causes?

Worth Causes is an initiative spearheaded by Worthy to help with fundraising for charities and non-profits. With this program, you can purchase and donate Worthy Bonds to the cause of your choice. And by donating bonds instead of just cash, you’ll be magnifying your donation by 5% per year.

Donors can simply make one-time bond donations to their favorite charities or they can choose to donate all their “Round-Up” bonds purchases as well. The latter option is really cool because it’s an easy and painless way to donate your spare change to the causes that you care about.

How Many Bonds Can Each Investor Buy?

Anyone over 18 years of age can buy Worthy Bonds. If you’re an accredited investor, you can buy as many bonds as you’d like. But if you’re a non-accredited investor, you’ll be limited to investing up to 10% of your annual income or net worth in Worthy Bonds.

Are Worthy Bonds FDIC-Insured?

No, Worthy Bonds is not a bank, so they are not insured by the FDIC or SIPC.

Should that cause you to lose sleep? Probably not. Remember, your risk is reduced by the fact that their loans are backed by actual assets like real estate, buildings, and inventory.

But the fact remains that there is no 100% guarantee that your money will always be safe with Worthy. Like other investments, you’ll need to weigh the benefits vs. the risk.

Should You Stash Some of Your Emergency Savings in Worthy Bonds?

The Federal Reserve recommends that Americans have at least 3 months of expenses saved in their rainy day funds while others recommend having up to 6 months of expenses saved. But where should you put those funds?

The stock market is a no-go because you generally shouldn’t invest money in the market if you may need to touch it in less than 5 years. But the average savings account, on the other hand, offers dismal rates. So would it be a good idea to invest some of your emergency fund in Worthy Bonds?

I believe the answer is “Yes.” I can’t bring myself to put 100% of my emergency fund in Worthy Bonds yet, since they’re not an FDIC-insured bank. But I’m strongly considering putting 25% to 50% of my emergency fund in Worthy Bonds. It would allow me to earn two to three times more than my money can earn with even the highest-yield savings account.

And, as someone who loves earning as much passive income as possible, that’s an opportunity that seems silly to pass up.

Clint, this is a good overview and assessment of a new investment opportunity. I am, however, concerned about the general economic impact on asset valuation of the current downturn sparked by COVID 19. Many businesses may not be able to repay the underlying loans these derivitive bonds are backed with, and the liquidation values of the underlying assets used as collateral may be significantly undervalued in the current climate, thus placing bond valuation and repayment at significant risk. Do you have a view on this concern?

Hi Alan, I do have some concerns about small business borrower default on the underlying loans as well, which is why I would never put all of my emergency savings in Worthy Bonds. However, my gut feeling is that Worthy would begin to lower the fixed interest rate on their bonds before they would just stop making payouts. Until that happens, I think it’s safe to assume that they’re business model is still working for them and they’re financially viable.

You should read their SEC annual statement, here is an excerpt: The Company generated net losses and had cash used in operations of approximately $508,000 and $416,000, respectively, for the six months ended June 30, 2019. At June 30, 2019, we had a working capital deficit, shareholder’s deficit and accumulated deficit of approximately $5.2 million, $161,000 and $700,000, respectively. These conditions raise substantial doubt about the Company’s ability to continue as a going concern for a period of twelve months from the issuance date of this report. During 2019, the Company continues to incur losses, however, a Form 1-A Regulation A Offering Statement allows the Company to continue to raise capital through the sale of Worthy Bonds as described elsewhere in this report.

Wow, just read the filing myself — incredibly eye-opening. Thank you for the heads up on this, Philip! Adding an update to the post right now.