College Ave is a lender that specializes in student loans and student loan refinancing products. They make good use of technology to speed up the approval process. Their undergraduate and graduate loans come with a good range of repayment options.

And, thankfully, they don’t charge junk fees on any of their products. Depending on your situation, College Ave could be a lender worth considering. Learn more about what they have to offer in our full College Ave student loans review.

What Makes College Ave Unique?

Let’s take a look at the distinctive features and benefits that sets College Ave apart from other student loan lenders.

1. Variety of Repayment Options On In-School Loans

When it comes to federal vs. private student loans, you’ll typically want to start with federal. Federal student loans come with many benefits like the ability to choose Income-Driven Repayment (IDR) and the possibility of receiving federal student loan forgiveness. But if you’ve maxed out your federal loans, private student loans can help bridge that gap. And it’s hard to beat the options that come with College Ave in-school loans. They give four repayment choices:

- Full Principal & Interest Payment: Start repaying your principal and interest right away to save the most. This will result in your highest in-school payment but your lowest overall cost.

- Interest-Only Payment: Pay the interest charges each month as you go during school. Your in-school payment will be moderate with this option.

- Flat Payment: Make $25 payments each month during school to reduce your accrued interest. This will result in your lowest in-school payment.

- Deferred Payment: No in-school payments required, but this will result in the most interest paid and highest overall cost.

For private student loans, that’s an impressive number of options. CommonBond is one of the few companies we’ve found who are able to match that kind of repayment flexibility on undergrad and graduate loans.

Related: Read our full editorial review of CommonBond

2. Attractive Terms on Graduate School Loans

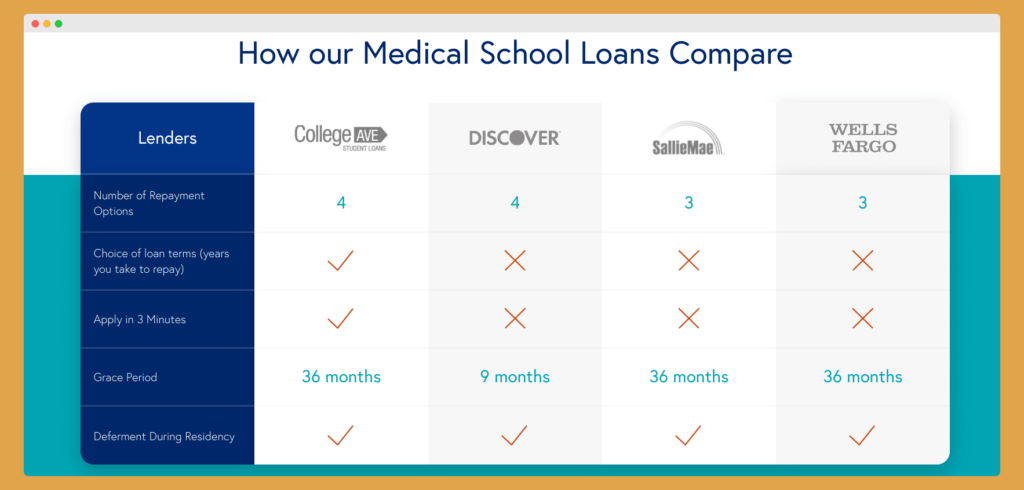

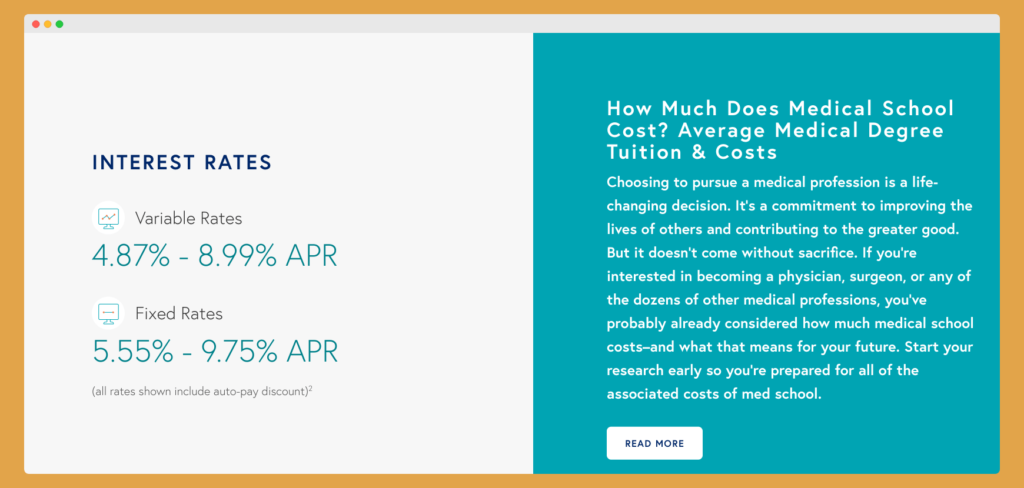

I mentioned earlier that private student loans should only be considered as a stop-gap once you’ve maxed out you federal options. And it’s graduate borrowers who find themselves in this situation most often — especially students pursuing professions that notorious for having high student debt like doctors, dentists, lawyers, and MBA students. The Department of Education has a $20,500 annual loan limit on Direct Unsubsidized loans for graduate students. If you’re in medical school or dental school, that might not be enough to cover your cost of attendance. In that case, you have two options. You can take out Grad PLUS loans (which you can take out up to the cost of attendance) or private student loans. The upside to Grad PLUS loan is that they come with the federal protections mentioned earlier. The downside is that they come with a fairly high interest rate of 7.08%. But the interest rates on College Ave grad school loans start in the high 4s.

- For instance, their med school loans come with a 36-month grace period and up to 48 months of deferment for residency.

- Their dental school loans come with a 12-month grace period up to 24 months of residency deferment.

- And their law school loans come with a flexible 12-month deferment for clerkship.

As you can see below, it’s hard to beat the blend of features and perks that College Ave is able to offer on their grad school loans.

Apply now for a College Ave student loan.

Apply now for a College Ave student loan.

3. Streamlined Approval Process

College Ave has one of the quickest application processes available today. They say it takes only 3 minutes to fill out the application and receive a credit decision. If you’re approved, you can e-sign the loan documents immediately. Then College Ave quickly sends your loan information to your school for approval. College Ave says that you can expect the entire process to take at least 10 days, but could be longer depending on the responsiveness of your school.

Apply now for a College Ave student loan.

4. Cosigner Release Is Possible

Most college students don’t have a significant income or long credit history. For this reason, you’ll most likely need a cosigner in order to qualify for any of the in-school College Ave student loans. But, thankfully, College Ave does make it possible to release your cosigner. They will consider a cosigner release once you’re at least half-way through your repayment period and you’ve made your last 24 payments on time.

5. Ho-Hum Student Loan Refinancing

While College Ave has some interesting perks built-in to their in-school loans, their student loan refinancing products are more lackluster. Most of the top lenders to refinance student loans have some sort of standout feature. For example:

- SoFi: Offers free career coaching and member experiences

- Earnest: Offers up to 180 repayment terms

- LendKey: Connects borrowers with local banks and credit unions

- Laurel Road: Will allow Parent PLUS loans to be transferred to children

- Splash Financial: Allow medical residents to make $1 payments during residency

But College Ave doesn’t offer any of the above perks. If you’re a current student, College Ave’s student loans are worth considering. But if you’re in the market for a refinance, I would look elsewhere (unless College Ave simply quotes you an interest rate that you can’t resist).

Apply now for College Ave student loan refinancing.

What Else Do You Need to Know About College Ave?

Here are a few more things you’ll want to know about College Ave before you make a decision. Continue reading our College Ave student loans review as we dive into the nitty-gritty details of their business.

Junk Fees

College Ave does a great job in this department.

- Origination fee: No

- Prepayment penalty: No

- Late fees: Yes, 5% of the late payment or $25, whichever is less, applied after a payment is 15 days late.

Customer service

College Ave services their loans themselves. They do have a third party in-house customer service team. If you have a complaint, they do have a process whereby your issue can be escalated to a customer service manager. However, borrowers do not get assigned a dedicated representative.

Repayment Periods

College Ave’s undergraduate student loan come with 5,8, 10, or 15-year terms. Some of their graduate loans also include a 20-year repayment term and their refinancing product does as well. Looking for more payment flexibility? You may want to check out Earnest. Related: Read our editorial review of Earnest.

Requirements

Here are the key requirements and eligibility criteria that you need to be aware of with College Ave.

- Minimum loan amount:

- $1,000 for in-school loans

- $5,000 for student loan refinancing

- Typical credit score of approved borrowers or co-signers: Not disclosed

- Typical income of approved borrowers: Not disclosed

- State Eligibility: Available in all 50 states

- Must have graduated to qualify for refinancing: Yes

- Must have attended a Title IV-accredited school to qualify for refinancing: Yes

Payment Flexibility and Forgiveness

This isn’t the first College Ave student loans review to point out that they don’t have a formal forbearance policy. Right now, they say that they evaluate forbearance requests on a case-by-case basis. That’s a bit of a bummer. But, thankfully, they do offer death and disability forgiveness. Find out why that matters.

Apply now for a College Ave student loan.

Conclusion:

College Ave could be a good fit for graduate students who have maxed our their federal Direct Loans. In that situation (and if you have good credit or a cosigner), you could get a better interest rate with a College Ave student loan. But you’ll want to make sure you compare rates with other top lenders, using a tool like Credible. And I would only pick College Ave for a refinance if they quote you an interest rate that the other top refinance lenders can’t match.