A new study by Bankrate has found that one-third of 18-37-year-olds prefer investing money they don’t plan to access for more than 10 years in cash instruments such as savings accounts and certificates of deposit. There’s one major problem with this: they’re not getting paid hardly anything whatsoever to do so.

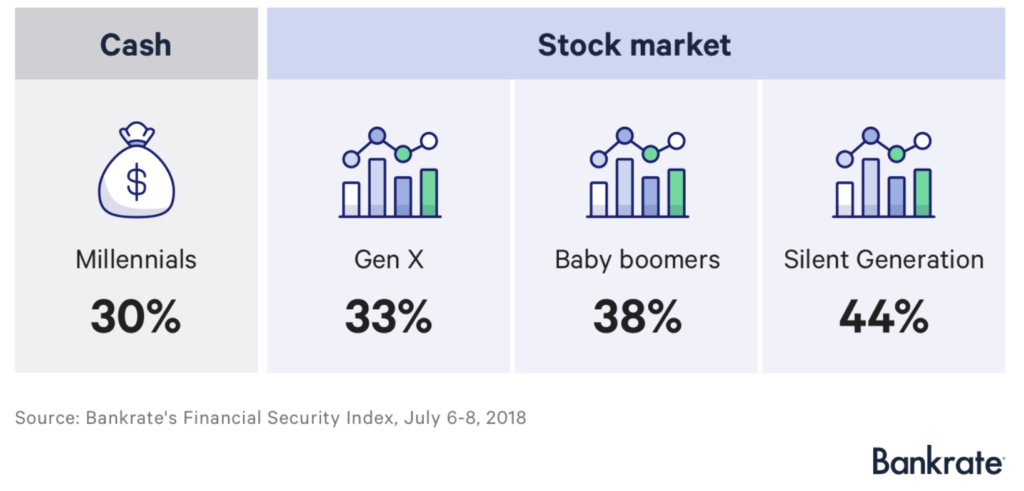

Even though many online banks now offer savings account interest rates over 2%, only 18% of American adults are earning even 1.5% percent on their savings. But even if they were taking advantage of these slightly better interest rates, savings accounts and CDs are a far inferior means of investing vs. the stock market for long-term investing. And the infographic below shows that the other generations seem to understand this.

Cash investments made up just 1 percent of the portfolio for younger millennials and 2 percent for those in their 30s.

So while millennials say they prefer cash over stocks, their actions don’t match their words. But back to our original question? Why do millennials say they prefer cash over the stock market? It’s hard to say for sure, but the fact that most of them were reaching adulthood right around the 2008 stock market had to play a major role. In 2008, the stock market lost 37%. Many millennials, like myself, saw their parents lose 30-60% of their stock portfolio in a 1-year span. I can totally understand why those from my generation would be distrusting of stocks.

But here’s the thing. Everyone who stayed in the market in 2008 (and not only stayed in but actually continued to regularly invest each month) ended up making back all their money and a whole lot more! Take a look at how the stock market has performed since 2008:

- 2009 +26%

- 2010 +15%

- 2011 +2%

- 2012 +16%

- 2013 +32%

- 2014 +13%

- 2015 +1%

- 2016 +12%

- 2017 +22%

- 2018 +6%

Not one losing year since 2008! As we preach over and over again here, while you should never put money in the stock market that you’ll need to access within 5 years or less, over the long-term it is an amazing investment vehicle. The stock market will have down years, but over time the trend will always be up.

So is cash bad? Absolutely not! Cash is great, and absolutely necessary, especially in regards to building your emergency fund. But as an investment vehicle, it’s a terrible choice. If you want your money to work overtime for you throughout your life and to build you a hefty retirement, then you need to be in the stock market. If you haven’t started investing yet, the best time to begin is now. Check out our investing guide to help you get started!