Looking to save money in college? Who isn’t, right?

College is expensive. That’s why over 45 million borrowers now have student loans.

But there are ways that you can save. And whether you save money by decreasing your tuition cost or cutting back on living expenses, it could help you graduate with less student debt.

That’s why I did a ton of research and interviewed over 30 personal finance experts for this guide. I wanted to uncover all the way ways (from the common to the crazy) that you could save money in college.

In total, I discovered 40 easy ways that you can save money in college. Let’s take a look at what they are.

Save Money in College on Tuition

Tuition is one of the biggest expenses that you’ll deal with during school. So if you’re going to save money in college, that’s a great place to start.

Here are a few strategies that could help you save money on tuition.

1. Fill out your FAFSA

Think that filing the FAFSA is only something that “low-income” students need to do? Think again.

No matter the financial situation of your parents, you need to fill out your FAFSA before your first year of college and then again each year.

There are all kinds of federal student loan scholarships and grants available for students regardless of their parents’ income. Plus, you’ll need to have your FAFSA on file in order to receive federal student loans.

And if you do have to take out student loans, you want them to be federal if at all possible.

2. Apply for grants and scholarships

Once again, don’t just assume that you won’t qualify for a grant or won’t win a scholarship.

There are tons of grants and scholarships that could be a perfect fit for where you live, the school you’re attending, or you’re intended profession.

But you’ll never get your hands on any of that money unless you try. McKinzie Bean, from Moms Make Cents, is a great example of someone who absolutely killed it with landing grants and scholarships.

The thing that saved me the most money in college was applying for scholarships and lots of them. I applied for university level scholarships, departmental scholarships, local scholarships, pretty much any scholarship I could.

Ultimately, I had all of my tuition paid for (I only paid books and fees) and even landed a scholarship that covered two-thirds of my housing for the first two years.

That’s incredible! But lest you think McKinzie is an outlier, trust me, you could have similar success. If you’re looking for proven success strategies, check out my guide, 5 Simple Ways to Make More Scholarship Money.

3. Dual enroll in high school

This is one is huge for anyone who wants to save money in college.

If you happen to have a college near you that offers duel enrollment, you could save a ton of money on school tuition. Dual enrollment courses are often offered completely FREE or at steep discounts compared to the tuition fees of most colleges.

By duel enrolling, my wife was able to graduate high school with her associate’s degree — essentially slicing away two year’s worth of tuition cost!

If you did the same thing, you’d easily save yourself $10,000-$40,000. That’s what I call “winning!”

4. Go to a community or state college

It’s insane how much more the same degree can cost you if you don’t pick an affordable school.

Check out the latest stats from the College Board on the average annual tuition cost at different types of schools:

- Public Two-Year College (in-district students): $3,440

- Public Four-Year College (in-state students): $9,410

- Public Four-Year College (out-of-state students): $23,890

- Private Four-Year College: $32,410

These numbers are mind-blowing. Let’s say that you spent your first two years of college at an in-district school and the next two years at an in-state college. In that scenario, your average four-year cost would be $25,700.

But if you chose to attend a private college instead? In that case, your average four-year cost would rise to $129,640.

That’s a difference of $103,940!

Now if you can attend a private school for free (or at a major discount) by taking advantage of grants and scholarships, I’m all for it.

But if you’d have to pay the full cost, you need to stay far, far away. Trust me, the “cool school” isn’t over $100k cooler.

Not now, not ever.

5. Enroll in spring and/or summer classes

Another way to save a lot of money going to college is to enroll in spring and or summer classes. Often, these classes are cheaper to take because they have a shorter duration. And if you can knock off a handful of classes during spring and summer session each year, you may be able to graduate from college up to a year sooner which will save you a lot of money and let you start your career sooner.

As an added bonus, difficult courses such as the sciences, stats, and math can be easier to complete and pass when taken in these condensed terms as well.

Save Money in College on Textbooks, Equipment, and Supplies

Tuition won’t be your only expense in college — not by a long shot.

You’ll also need to buy textbooks, a computer, and other school-related supplies. If you’re going to save money in college, you’ll want to reduce these expenses too. Here are some ideas that could help.

6. Borrow textbooks

Textbooks can be crazy expensive. It’s not unusual for them to cost in the hundreds of dollars.

But if you have friends that already own a textbook that you need, they may be willing to lend them to you for a few months. Logan Allec, from Money Done Right, said this strategy worked well for him.

I hated getting ripped off by paying hundreds of dollars for textbooks in college, so I would make it a point to always (ideally) borrow from someone who took the class before me or from the library.

Alex Nerney, from Create And Go, said borrowing textbooks was one of his go-to strategies too (even if he wasn’t 100% honest about this strategy with his professors).

Books were a challenge. It ended up being a game with each professor because they wanted you to buy the latest edition even if the books had not changed. So my friends and I would share a book or buy the later edition and just claim we made a mistake when they asked about it.

And, as we’ll see later, borrowing books from the campus library can be a great textbook hack as well.

7. Rent your textbooks

Can’t get away with using an older edition of your textbook? That’s ok, there are still ways you could save money. Why not rent the textbook instead of buying it?

There are several websites today that make it easy for you to rent textbooks. A few of the most popular textbook rental companies include:

Most textbook rental sites expect some ordinary wear and tear and may even allow some highlighting. But be careful not stain or tear any pages or you may be forced to pay the purchase price for the book.

Related: The 11 Best College Textbook Rental Sites

8. Buy eTextbooks

Physical textbooks are not only expensive but also heavy to lug around and easy to lose. Before you buy or rent a textbook, find out if your professor is cool with you getting an e-textbook. If so, check out sites like VitalSource which can save you up to 80% on your textbook purchases.

And if you’re the type of person that likes to highlight and make notes in your textbook, have no fear! You can still do that too. And as an added bonus, their app called Bookshelf will read your text to you during your commute or while you’re studying in between classes.

9. Sell back your textbooks

If you do decide to buy your textbooks, you can always sell them back later.

Don’t expect to get 100% of what you originally paid for it. But if you keep your textbook in mint condition, you may be able to sell it for 50%-80% of your original cost. That’s still a big help.

If you want to sell your textbooks, you can use Amazon’s textbook buyback program. Or you can use other sites like DeCluttr, Bookbyte, BookScouter, or Cash4Books.

10. Don’t overspend on electronics

Erica Gellerman, from The Worth Project, was so serious about saving money in college that she went extreme — she lived without a smartphone.

I used a cell phone. Not a smart phone, but a cell phone (no data, no camera, no fun!). I even used this cell phone when I went to business school and I was probably the only person without an iphone. But six years of living without a smartphone? I saved so much money.

Am I saying that you should ditch your smartphone? No, not necessarily. Cell phones today are wallets, calendars, media streaming devices, and flashlights all rolled into one. But the spirit of Erica’s choice is what you want to follow:

Just because “everyone” else has a particular gadget, doesn’t mean you need it. And when you can buy a cheaper equivalent, do it.

Let me give an example. In today’s world, a laptop is basically a requirement for getting things done in college. But buying a school computer doesn’t have to break the bank.

While some students assume that they need to pay over $1,000 for a new MacBook, that’s just not the case. You can easily get by in college with a sub-$500 Windows laptop. And my brother used a Chromebook in college.

Related: 5 Best Chromebooks for Students in 2019

If you are dead set on buying a MacBook, see if you can save money by getting a used or refurbished one.

Before buying any piece of tech, ask yourself “Do I really need this?” Just asking yourself that one question before making any purchase could save you a ton of money in college.

11. Buy academic software on the cheap

Some classes may require you to buy a particular software product for your computer. Jim Wang, the founder of Wallet Hacks, has some ideas for how to save on these expenses when they pop up.

I took advantage of academic software discounts or freebies – meaning you can download and use a lot of expensive software packages for cheap or for free when you’re a student. My wife teaches at the University of Maryland and their TERPware system gives you access to Office 365, Windows 10, Adobe Creative Cloud Apps, and a whole lot more.

Don’t just assume that you have to buy a piece of software at full price. Ask around to find out if there are any student discounts you can take advantage of.

Speaking of student discounts, that’s what our next section is all about.

Save Money in College By Taking Advantage of Student Privileges

Being a student has its perks. And many of those perks could help you save money in college. Here are a few ideas.

12. Use your school’s interlibrary loan system

As we mentioned earlier, borrowing textbooks from your campus library is a great way to reduce your textbook cost. But what if your campus library doesn’t have the book you need?

While you may assume that you’ll just have to cough up the change to buy the book yourself, that may not be the case. Most schools have an interlibrary loan system, much like public libraries too.

If another school library has the book you’re looking for, you may be able to have it sent to you. Jerry Brown, from Peerless Money Mentor, used this strategy when he was in college.

When I was in college, to save money on textbooks, I’d sometimes use my library’s interlibrary loan system to request books I needed for class. I found that this hack worked when my professor allowed students to use an older edition of the textbook.

But, as Jerry points out, this idea won’t work if you need to have the book in your hands immediately.

The only downside to this I found was waiting a week and a half for the textbook to be sent to my school’s library system.

For this strategy to work, you’ll need to give yourself adequate time for the book to arrive.

13. Use the campus gym

Does your campus have an exercise room that’s free for students to use? Many do.

If so, this is a great way to save money. Why spend $20-$50 on a gym membership when you have a free option within walking distance of your dorm.

Speaking of which, using the campus gym will help you save on gas too!

14. Flash your student ID

Many retail stores, restaurants, and theaters offer student discounts. To get these discounts, you typically just need to show your student ID.

Chhavi, from Mrs. Daaku Studio, took full advantage of this during college.

For eating out, drinking or watching a movie, we always went during happy hours or visited places that gave discounts for student ID. We were able to save a lot of money because of our student ID.

Ask your friends which places they’ve heard offer student discounts. Then create a list of all the places where your student ID can save you money.

Then, when you’re out and about, shop and eat at places from your list as often as you can. If Store #1 is willing to give you a 10% student discount and Store #2 isn’t, which store are you going to shop at for the next 4 years?

Let’s all say it together: Store #1.

15. Apply for an Amazon Prime Student Membership

Did you know that as a student, you can get 6 months of free Amazon Prime? And after that, you can pay half-price for the remainder of your school career? It’s all part of Amazon’s Prime Student membership program.

In order to qualify for Amazon Prime Student, you’ll need a .edu email address. After your 6-month trial has ended, it’ll cost you $59 a year (or $6.49 per month) to keep your Amazon Prime Student memberships.

That’s half the regular price of Amazon Prime membership, which is currently $119 a year (or $12.99 per month).

16. Attend free campus activities

When you’re living the college cash-strapped lifestyle, you probably won’t have a lot of “fun money” lying around.

And entertainment can be expensive. One trip to the movie theater alone could set you back $30-40 if you buy popcorn and a drink.

But your school probably has a full calendar of activities that you can take part in for free. From pick-up sports to movie nights to free concerts, there’s bound to be an upcoming activity that appeals to you.

And as long as you’re friends are with you, I can promise that you’ll have just as much of fun…actually you’ll probably have even more fun because you’ll be saving money.

Save Money in College on Food

Who knew it was so expensive to make generic food in bulk? A 2017 study by The Hechinger Report found that the typical student pays more for the college meal plan than the average American spends on food.

How can you reduce this cost? Here a few tips.

17. Get the most out of your campus meal plan (or cancel it)

Colleges typically two types of meal plans — pay-per-swipe plans and pay-per-item point plans.

Regardless of which plan your school uses, there are things you can do to maximize what you get for what you pay. For one, make sure that you don’t let swipes or points go to waste.

With most plans, all the points or swipes that you paid for will expire at the end of the semester. If you have a lot of unused points or swipes left over at the end of the semester, that’s like throwing money down the drain.

You may also want to consider reducing your dining plan amount. For instance, if you never seem to make it the cafeteria for breakfast (or could just eat cereal in your dorm), you may want to only budget for two swipes a day instead of three.

And if you have access to a kitchen, that changes the game. In that case, you could literally save thousands of dollars by doing your own cooking.

18. Stick to your list at the grocery store

As Tom Blake, from This Online World, explains, even those who do their own cooking need to stay disciplined with their spending.

One of the main ways I saved money while in college was by sticking to an absolutely rigid and minimalistic meal plan. I essentially sustained myself on oatmeal/eggs for breakfast, and some form of grain/vegetables/chicken for lunches and dinner.

By buying in bulk from wholesale stores or when I found great sales, I was able to save money in the long run and shop less frequently. Plus, this system really made my life easier as a student who had to juggle work and school!

Jarek, from Time In The Market echoed Tom’s sentiments.

Beyond that, I lived at home which was a big saving and since college was nearby, I didn’t really miss out the experience that much since I could head over any time. I also ate a simple diet that consistent of whatever was on sale that week combined with oatmeal, eggs and other cheap items.

GP, from Entirely Money, was so extreme with food budgeting that he could get by on $20 a week!

“I saved money in college by drastically cutting my food expense. There were three main staples that I bought; Ramen (typical college food), large bags of frozen shredded potatoes, and eggs. I could get by on about $20 a week at the grocery store.

Sound crazy? Perhaps. But no crazier than beginning your career behind the 8-ball with massive student loans.

Sometimes we have to do a little “crazy” to reach our financial goals.

19. Start a cooking cooperative

This was a unique idea that Julie Rains, from Investing To Thrive, shared.

One way I saved money (and time) in college was with a cooking cooperative. Three of us alternated making dinner one night each week; we made enough for the group and shared meals.

I love this idea! If you have some fellow frugal friends at your school, see if they’d be interested in doing something like this!

20. Use coupons

Don’t worry, I’m not going to tell you to become an extreme couponer.

I know you’re too busy in college to spend hours every week clipping endless coupon magazines. And no one needs 100 bags of Funyans (even if you think you do) or 10 pallets of Gatorade.

But that doesn’t mean you should ditch coupons all together. If you’re heading out to buy cereal, chicken, or ice cream, check on your phone first to see if any local stores are offering special deals.

If you can find a store offering a BOGO on something that you needed to buy anyway, that’s a major bonus!

21. Use a cash-back grocery app

Wouldn’t it be great if somebody paid you to shop for your groceries? Well, that’s exactly what cash-back grocery apps do.

And some apps like Flipp also come with electronic coupons that are paired up with the products in weekly flyers so you can save money on your groceries AND get paid cash back for them! Some of the best cash-back grocery apps include Ibotta and Checkout 51.

22. Eat out during happy hour

Of course you’re going to want to relax with your friends and eat out sometimes after you’ve been hitting the books all week. And eating out doesn’t mean you can’t have fun without blowing your budget.

Lots of restaurants have a “happy hour” with great deals on drinks, appetizers, and even some meals. You can have a great time, fill your belly with some great eats, and share the bill with friends to make it even cheaper so you can eat out more often.

Save Money in College on Housing

According to the College Board, these are the average costs of room and board at each type of college:

- Public Two-Year College (in-district students): $8,660

- Public Four-Year College (in-state students): $11,140

- Public Four-Year College (out-of-state students): $11,140

- Private Four-Year College: $12,680

If you remember our stats from earlier, you’ll notice something interesting. At both public two-year and four-year colleges (in-state), room and board cost more than tuition.

That’s why if you want to save money in college, you need to think about ways that you can save on housing. Here are a few ideas.

23. Live at home

Yes, I know that’s not a sexy option. But it could save you a ton of money.

I lived at home throughout my college career and it’s the #1 reason I was able to graduate debt-free.

If you’re going to attend a local college anyway, you need to seriously ask yourself this question — “Is the college dorm experience worth $35,000 to $50,000 over a 4-year span to me?”

24. Live off-campus (and split the rent with roommates)

Even if living at home isn’t an option during college, you may still want to explore living off-campus.

If you’re able to split an apartment or house with some roommates, it could cost you significantly less than the college dorm.

Tana Williams, from Debt Free Forties, said that this one of the hacks that helped her save money in college.

When I went to the same out of state college with my brother, we had several hacks that we used to save money. We stayed in a small, cheap apartment located across town from the school. Rather than going with student housing, we were able to find something less expensive by living together in a different area.

This may not be a viable option for your freshman year. But once you’ve been at school a year or so, you may want to ask some of your cost-conscious friends if this is something that they’d be up for.

It could save you money, plus probably give you a lot more personal space! If you’re looking for a place to rent, you may want to check out College Rentals, College Student Apartments, Campus Scribz, or Rent College Pads.

25. Commute to school

If you need to or choose to rent your own place while going to college, look for a place to rent farther away from the campus because it can save you a lot of rental money each month. That’s because you’ll pay a premium for rental housing near the campus since it’s in higher demand by students who want to live close and walk to school.

Just make sure the area you choose to rent is safe and not so far away from school that you dread the commute every day and lose your rental savings on the cost of transportation to get there.

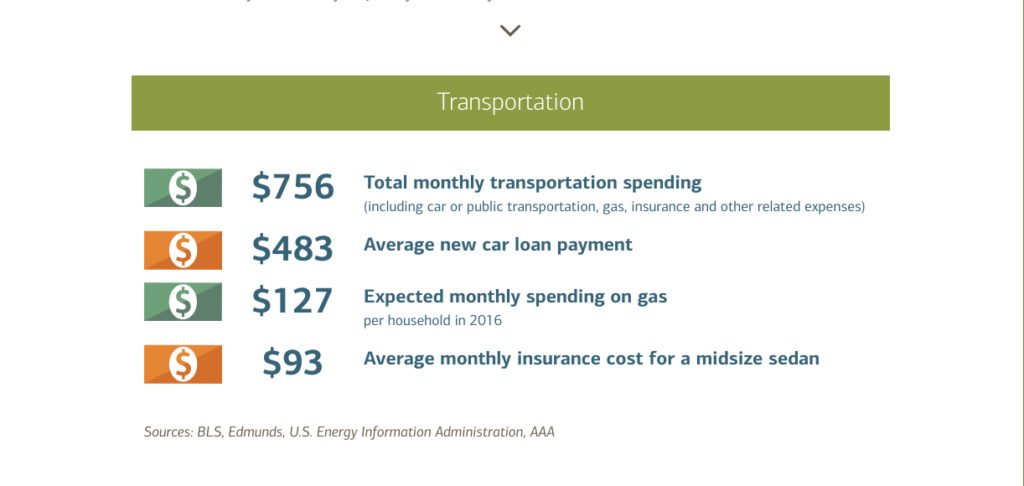

Save Money in College on Transportation

According to Bank of America, the average American spends over $750 a month on car ownership.

That adds up to an annual cost of over $9,000 a year. So what does that mean?

That means for many college students, tuition is actually their third-highest cost in college, behind housing and transportation.

One of my favorite ways to save money on transportation is by buying the right car in the first place. But here are a few other ways to bring that cost down.

26. Ditch the car

If you’re going to be on campus 90% of the time anyway, do you really need a car in college?

With Uber, Lyft, and other rideshare services, you can always get a ride when you need one. But unless you live or work off-campus, you may not drive enough to make your car payment worth it.

Even if you do keep the car, it may save you money to leave it in the driveway more often and use public transportation instead. Scott Henderson, from Simpli Finances, said that this worked well for him in college.

I saved money in college by taking the electric train system. My commute was longer but I could read, write and do homework. I was driving a Jeep and so it saved me a ton of gas money and I’m sure I got better grades because of it.

27. Bike to class

By biking to class, you can save on gas while getting in some exercise too. Plus, as Jose Sanchez, a CFP specializing in retirement planning in Rio Rancho and Albuquerque, explains, it could help you save on school parking fees.

I avoided all parking fees by riding my Trek Moutain bike everywhere. I did not live close to campus, so most days I drove my pickup truck with my bike in back and parked for free miles away from campus. Not paying the $150 annual fee gave me more coin in my pocket and a greater appricitation for biking.

That’s some serious planning and work to save $150…

…Jose’s a man after my own heart.

28. Live near your campus

If you do decide to get an off-campus apartment or house, try to find one close to the university.

Riley Adams, from Young And The Invested saved a lot of money in college by staying at a place right across the street from his school.

In college, I chose a place directly across the street from campus. This saved me money on transportation expenses like gas, maintenance, and a parking permit.

And Riley said that it also allowed him to get a few more things done (or just get more sleep) before school.

This also saved me the time necessary to drive to campus and allowed me to sleep in a bit later if I had a morning class or gave me more time in the morning to exercise and run errands, knowing I was only a 5 minute walk from class.

29. Schedule your classes efficiently

If you do have a long commute, you’ll want to limit your trips. Vicki Cook, from Women Who Money, was able to do that by thinking through her class schedule.

One way I saved money in college was to create a class schedule where I put as many classes as I could on the same day. They were LONG days – but I rarely blew off a class! The free days allowed me longer blocks of time to work a part-time job and study.

And Marc from Vital Dollar explained that smart class scheduling could help save on more than just transportation. It helped him reduce his tuition bill too.

I saved money by taking a full load of classes each semester. The base tuition allowed was for 12 – 18 credits each semester, so it was no more expensive to take 18 credits than the average of 15 credits. I usually had 18 credits each semester and I was able to finish a five-year program in 4.5 years with that simple change.

If your school handles school credits in a similar way, this is definitely a college hack that you need to be taking advantage of!

30. Carpool to the campus with friends

If you’re going to live away from campus and need or plan to drive to school, you can save some money by carpooling or ride sharing to school with friends or fellow classmates. This can save you money on gas as well as parking— not to mention wear-and-tear on your vehicle.

Save Money in College on Shopping

So far in this guide, we’ve only covered your required expenses in college. But we all spend lots of money on things we don’t need.

And if you have trouble keeping your money in your pocket when you’re out and about on Saturdays, that’s something you’re going to need to get under control. Here are some ideas.

31. Limit your wardrobe

A few years ago, I would have been in the minority encouraging you to reduce your wardrobe to a few of each item.

But with the advent of minimalism, having fewer things has all of the sudden become somewhat “cool.” Whether you’re a Marie Kondo fan or not, limiting your wardrobe is a good idea. Most of us wear the same 2 pairs of jeans every day and the same 8-10 shirts.

Sound familiar?

If so, just stick with your favorites and chuck everything else. And then wait for “back to school” and Christmas as your designated times for a wardrobe refresh.

32. Shop at goodwill (or the local thrift store)

If you do you have to buy a new pair of jeans, don’t just assume that you have to cough up $50.

You can save a ton of money by shopping at your local Goodwill or thrift stores. Many times the clothes that you’ll find there are basically brand new.

And if you hit them at the right time, you can find some really nice name brand stuff…at discount brand prices.

33. Use cash

R.J. Weiss, from The Ways to Wealth, said that using cash when he was out shopping kept him from overspending.

When going out, I would leave my debit card at home. Instead, I would withdrawal $20 or so in cash early in the day and that was my spending money for the entire night.

Many of us naturally spend more when we use plastic. If you struggle with this too, try using R.J.’s strategy.

There’s just something about physically handing over money that psychologically makes us more aware of our spending.

34. Rent out your clothes and accessories

This might sound a little over-the-top but it really is a thing! And if you like your name brands and just have to have them, why not earn some of the money back that you paid for them? Besides, name-brand clothing is often trendy and can go out of style quickly so why not make some money back for your next clothes shopping trip?

Sites like Le Tote, StyleLend, and Rent My Wardrobe will show you how to rent out your clothes as well as footwear, handbags, and accessories.

35. Use a cash-back credit card

If you’re the type of person who handles money well and is faithful at paying off your credit card every month (before it accrues interest), then using a cash-back credit card for all your purchases can be a smart idea.

Most cash-back credit cards pay you back a percentage of your purchases in cash once a year on categories like groceries, gas, and restaurants which are common expenses for students. Look for a no fee cash-back credit card like the Chase Freedom Unlimited credit card. And, ideally, sign up for the card when they’re offering some kind of bonus you can benefit from.

And don’t forget to use a cash-back app like Rakuten online or Dosh when you shop with your cash-back credit card to earn even more money back!

36. Plan ahead and save for special occasions

Plan ahead and save money by putting money aside for nights out, gifts, and special occasions and holidays. Before you spend any money though, look for the items you want on local buy and sell sites, Craigslist, or eBay.

Also, be sure to plan ahead and buy gifts in advance when they’re on sale such as during Black Friday. And remember to combine your purchases with cash-back credit cards (if you use a credit card) and cash-back apps when you can.

Save Money in College on Travel

Do you go to school in a different town or state than where you grew up? If so, there’s a good chance that you do a lot of traveling back and forth. Whether you only travel home during summers or you just to make it back for every holiday, travel can be expensive.

Here are some ways that you slash your travel costs to help you save money in college.

37. Use travel credit cards

This one may ruffle a few feathers. A lot of people think that college students shouldn’t have credit cards. And I can understand that.

Benjamin Brandt, from Retirement Starts Today Radio, said that he regrets having a credit card during his university days.

I once applied for a credit card for a free T-shirt! Of course, I immediately misused that card and that mistake followed me around for years. All for a free T-shirt!

Benjamin brings up an important point. Credit card debt can be a major problem for college students. But it’s the credit card debt, not the cards themselves that are the problem.

Related: Should Young People Use Credit Cards

When handled responsibly, student cards can help you begin to build credit from scratch. Plus, you may even be able to earn rewards that can reduce your travel expenses.

Don’t plan on getting a credit card in college? Your parents may have some points that they’d be willing to let you use. This is how my parents were able to fly my brother back and forth from Florida to California during his college years.

If it weren’t for the free flights they were able to nab with credit card points, he wouldn’t have been able to afford to come back home during Thanksgiving and Christmas break.

38. Hitch a ride with a friend

Do you have a classmate who lives in the same town as you? Or perhaps they live in a different town, but their route will take them right by yours.

If so, why not carpool and split the gas cost?

Splitting travel cost with friends is just a great idea in general. If you want to check out a nearby tourist destination, see if you can get some friends who’d be interested in joining you. That way you all can split the hotel cost a few ways.

Is your circle of friends more into camping and other outdoor activities? If so, you could consider splitting the cost of an RV rental with one of the 3 Best RV Rental Companies.

39. Use travel comparison shopping websites

If you have to fly, book a hotel, or rent a car, it pays to shop around.

With the top travel sites, you can shop multiple airlines, hotels, or car rental agencies at once. And you can set up price alerts with most of them as well.

Here are a few of the most popular travel sites:

And there are many more.

One more thing. If you want to land the absolute steepest discount, you should use the bidding tools from sites like Priceline.

Just know that you won’t know actually what you’re going to get (i.e. hotel, airline, car rental agency) until after your bid is accepted. But if you’re ok with that, it could save you a ton!

40. Find student travel tours

Want to travel the world? It turns out that your college years may be one of the best times in your life to do so.

There are lots of overseas group tours that take place over the summer and offer discounts specifically to students. To get started, try checking out EF Tours or STA Travel.

Save Money in College by Splitting Costs.

There are a number of ways you can save money college by splitting expenses with others. Here are a few of our favorite cost-splitting ideas.

41. Stay on your family’s phone plan

Nearly without fail, it will cost you more money to set up your own phone bill than to just stay on your family’s plan.

Wanting to carry your own weight? I like that attitude.

But that doesn’t mean that you have to remove yourself from your parents’ plan. Instead, you could just transfer money to your parents each month to cover your portion of the bill.

42. Stay on your family’s health insurance plan

Some colleges offer in-house health insurance. That sounds good but it may not be your most cost-effective option. Julie Rains, for instance, was able to save her son over $1,000 by keeping him on the family’s insurance plan instead.

I had to actively decline university-provided and billed health insurance for my older son as he was covered under a family policy. That required being diligent about the process (which changed during his college years) but was worth the effort to avoid about $1,000 per year in insurance charges.

Since the passing of the Affordable Healthcare Act, you may be able to qualify for low insurance premiums on the Healthcare Marketplace. But you may still want to stay on your parents’ plan if there are specific doctors that you want or need.

43. Share your video and music subscriptions

Are you paying for Spotify, Apple Music, or Google Play Music?

If so, did you know that most of these services allow up to 6 people to share the same plan? Ask your friends if any of them would like to have unlimited music streaming and would be willing to split the cost. You can use the same strategy for most video streaming subscriptions, including Netflix and Hulu.

You could even split the cost of TV using this strategy. For instance, me, my parents, and my brothers all split the cost of our YouTube TV subscription. By splitting the cost 4 ways, it only costs us $12.50 each — for 70 channels!

Related: 15 Best Alternatives to Cable TV

44. Split the cost of dorm equipment.

Do you want to buy a TV for your dorm?

Instead of shelling out the money all by yourself, why not see if your dormmates would be willing to split the cost. The same goes for video games, consoles, and controllers.

And this concept could apply to more than just entertainment expenses. If there’s any dorm appliance or tool that everyone is going to benefit from, it’s only fair that everyone share in the cost.

Save Money in College by Making Money.

As Kyle, from Financial Wolves, put it, sometimes the best way to save money is to make money!

The best way to save money is to work part time! It’s a great way to earn money while going to school and to challenge yourself with time management and allocation. I worked all four years during college and it helped me out so much in the long run.

Any job in college is a good job. But below are a few job ideas that are especially great for college students.

Related: 25 Amazing College Side Hustles

45. Work for an employer that offers tuition reimbursement

Did you know that several companies offer tuition reimbursement to their employees?

Starbucks has gotten a lot of press coverage for its impressive college achievement program.

But Starbucks isn’t the only business that offers tuition reimbursement to employees. There are several more companies that will give you a paycheck plus help pay for your college tuition.

For a complete list of over 20 companies that offer tuition reimbursement, check out The Krazy Koupon Lady’s Tuition Reimbursement Guide.

46. Work on campus

Working on campus not only saves money on gas, but it could also come with other perks. For instance, Drew DuBoff, who helps entrepreneurs scale their business, said his campus job helped him save on food.

I worked for campus dining part-time. I was able to get a staff meal whenever I worked (which was 4-5x per week) and this allowed me to save money on a larger meal plan. I was able to get 7 meal swipes per week instead of 14. Considering that extra money would’ve been tacked on to my student loans, I’m all for reducing that principal and making money in the process. That’s what I call a double whammy!

Luis Rosa, CFP from Build A Better Financial Future, had a similar story to share.

I became a Resident Assistant (RA) on my sophomore year, no real pay except for a small stipend but I got my own room and a 19 meal plan!!!

And Urgen Kuyee, a nurse and freelance writer, said that another benefit of campus jobs is that they tend to be more understanding of your college schedule.

I believe one of the best ways to save money during college is to work on campus. Find a job on campus that’s flexible with your academic schedule and make some cash on the side so you have more money to save. I worked as a tutor for first year nursing students when I was in college. The work was easy peasy. The best part was I could pick my own schedule.

47. Work during holidays

Yes, I know this one looks awful on the surface, but hear me out. If you’re not going to be able to travel home for the holidays anyway, you have two options.

- You could sit in your dorm room and feel depressed.

- Or get out and make some money.

And since most people don’t want to work on holidays, employers may be willing to pay you a premium. Plus, as Sara, from Gathering Dreams shares, there are tons of seasonal jobs that aren’t available at any other time of year.

“I saved quite a bit of money in college by working during every holiday season and weekends. I did everything from data-entry jobs, to wrapping Christmas presents to sell t-shirts. No job was too small as long as I was paid a decent amount. I put all that money in a separate savings account which helped me to build up a travel fund.

48. Find a job that gets you discounts or freebies

Val Breit, from The Common Cents Club, knew what she was doing by applying for a job at her campus gym.

I wanted to take fitness classes that weren’t offered at the campus gym. Instead of paying for a gym membership, I got a part-time job at the front desk. It worked around my class schedule, and I got a free membership with access to all the fitness classes. This saved me over $400 per year in college!

This is yet another example of getting paid to be given a free benefit. That’s the pinnacle in college cost hacking!

49. Land internships that count as class credit

Dillon, from Dollar Revolution, said that he was able to land a paid internship that also reduced his tuition cost.

Best thing I did to save AND earn money during college was to apply to have my paid internship also count for school credit. So I was getting paid and fulfilling a class requirement at the same time! It also led me to have a full-time job upon graduation despite the recession at the time.

This is yet another reason why I love internships so much. In fact, landing an internship in college could be one of the best ways to jump-start your career.

50. Flip items online

Do you like shopping and finding great deals? Love hitting the garage sales and flea markets to find cheap cool stuff? Why not turn that fun into some extra cash while you’re going to college?

Where do you find items to sell? Your parents’ garage and basement are ideal places to start. Lots of valuable stuff can be found on Craigslist for cheap or even free or at your local Goodwill and thrift stores too. When you get an item, clean it up (if needed), take some great photos of it, and sell it on your local buy and sell sites or eBay for a sweet profit.

51. Earn money freelance writing

I know this might sound crazy but this is my full-time job so I know this works! In fact, I took my freelance writing from zero to a full-time income in just 7 months when I first started—with NO previous experience. Wondering how to start?

Make a list of the hobbies and topics you’re interested in and don’t rule anything out. You’d be surprised at the things you can get paid to write about! Then hop online and look for writing gigs for free on sites like Contently, ProBlogger, and BloggingPro.

The great thing about freelance writing is you can do it whenever it suits your schedule and from anywhere you have an internet connection.

Related: Freelance writing vs. blogging: which is best?

Conclusion:

So, there you have it — 50+ ways to save money in college.

Did you use any of these ideas while you were in college? Or did you use a different strategy that I didn’t cover?

If so, let me know in the comments below!

Not a smart phone, but a cell phone (no data, no camera, no fun!).

I even used this cell phone when I went to business school and I was probably the only person without an iphone.

In today’s world, a laptop is basically a requirement for getting things done in college.