Less than a month ago, I became a Christian Healthcare Ministries member. But my experience with them began much earlier. In December 2016, Scott, one of my best friends, and his wife Sarah welcomed their first child into the world.

Their precious daughter, Eleanor, was perfect and we were all so excited for them. But less than 3 months later, Scott and Sarah noticed a lump in Eleanor’s stomach. Concerned, they brought her to the doctor.

They were devastated to find out that their beautiful baby had a form of cancer known as neuroblastoma.

And just like that, they were thrust into a fight for Eleanor’s life. And that fight is still ongoing. I’m thankful to be able to share that, earlier this year, Eleanor was pronounced as having no evidence of disease. But she’s still undergoing treatment that is meant to help her avoid a relapse.

Why do I share this story? Because Scott and Sarah were Christian Healthcare Ministries members when Eleanor was first diagnosed.

And they’re still members today.

And, despite the fact that the cost of Eleanor’s treatments has grown into the millions, nearly all of their expenses have been covered by Christian Healthcare Ministries.

So, No, I’m Not Fully Unbiased On This One.

I fully admit that I’m not completely unbiased when it comes to Christian Healthcare Ministries (CHM). Honestly, I’m really thankful that CHM has been there for my friends when they needed help the most.

But, even so, I decided to shop around before choosing my own healthcare sharing ministry. After taking a look at the competition, I still chose Christian Healthcare Ministries. I explain why in my full Christian Healthcare Ministries review below.

What Are Healthcare Sharing Ministries Anyway?

Let’s make one thing clear from the outset. Healthcare sharing is not insurance. But the two bear a lot of similarities. Here is how the Affordable Care Act (page 148) defines healthcare sharing ministries (HCSM).

The term “healthcare sharing ministry” means an organization in which the members share a common set of ethical or religious beliefs and share medical expenses among members.

There are four additional requirements:

- The organization must be a 501(3)(c) non-profit

- Members must be retained even after they develop medical conditions

- The organization must have been in existence and continuously sharing member’s medical expenses since December 31, 1999.

- Each HCSM must submit to an annual audit by an independent certified public accounting firm

According to HealthInsurance.org, there are currently 104 certified healthcare sharing ministries that meet these criteria.

Often, members will have more affordable premiums than what they would pay for traditional insurance. But HCSMs are not required to follow ACA guidelines. So they may not cover pre-existing conditions or the 10 essential health benefits.

Christian Healthcare Ministries Plans and Pricing

Now that I’m a full-time freelance writer, I don’t have employer-sponsored healthcare anymore.

And the quotes that I got on the Marketplace just about gave me a heart attack.

So I wanted to see if I could save money by using a healthcare sharing ministry. And it turns out that, across the board, they were just about all more affordable than traditional insurance.

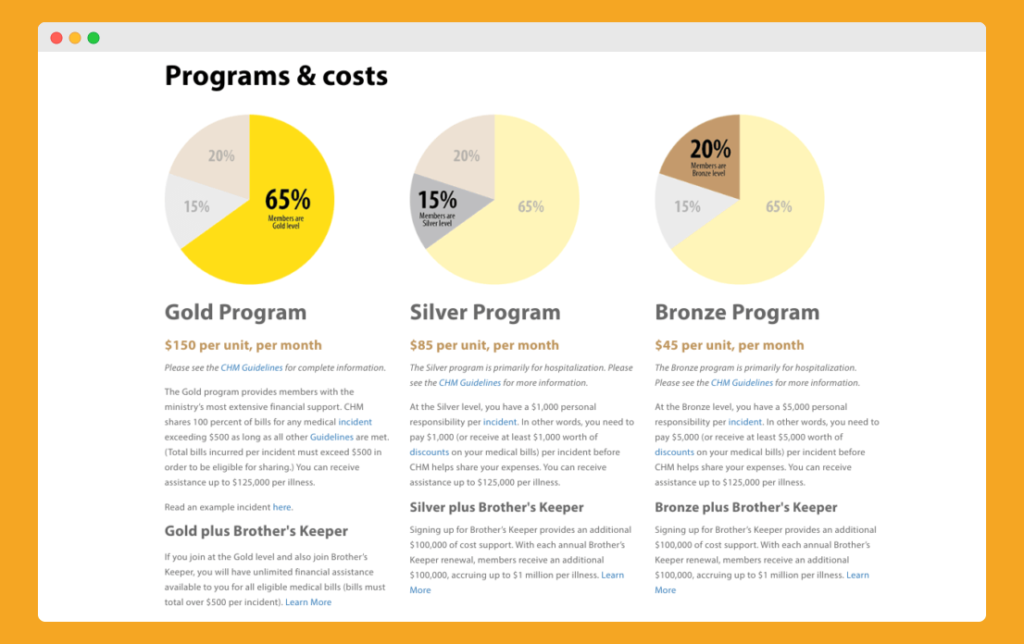

But for our family’s situation, we got the best price with Christian Healthcare Ministries. They have three pricing tiers: bronze, silver, and gold.

- A single person is one unit

- A married couple is two units

- A family (husband, wife, and children) is three units, regardless of the number of dependent children. (Different units may participate in different programs, Gold, Silver, or Bronze)

- A single parent and his or her children count as two units

The Bronze program costs $45 per unit, the Silver program costs $85 per unit, and the Gold program is $150 per unit.

Deductibles Are “Per Incident,” Not “Per Year”

With CHM you don’t have a traditional deductible. Instead, CHM will begin sharing your bills once you’ve spent up to your responsibility per incident. Here is your personal responsibility per-incident on each program:

- Gold: $500

- Silver: $1,000

- Bronze: $5,000

An “incident” is defined as one testing or treatment. You can have multiple “incidents” per illness. Learn more about the differences.

Because of their high per-incident member responsibility, Silver and Bronze are mostly only intended to be used for hospitalization coverage.

Who Can Be a Christian Healthcare Ministries Member?

Christian Healthcare Ministries is meant to be a way for Christians to share other Christians’ medical bills. So in order to join, you’ll need to be a Christian who attends worship regularly.

You’ll also need to be someone who abstains from smoking and all tobacco products. There are no restrictions based on age, weight, geographic location or health history.

How Christian Healthcare Ministries Works

The main principle behind CHM is that you pay the healthcare providers and CHM pays you. Let’s dig a little deeper into how the process works with Christian Healthcare Ministries.

1. You go to do the doctor or hospital for treatment. When they ask you for your insurance information you say, “I’m self-pay.”

Right off the bat, saying that you’re self-pay may qualify you for discounts. And with CHM that’s a big deal (more on that later).

2. Next, you’ll tell your healthcare provider to send bills directly to you.

CHM discourages its members against paying medical bills in total up-front. They say that their staff can help negotiate discounts of up to 40%. But if you pay for everything up-front, negotiations are officially over before they begin.

3. Once you receive a medical bill, you’ll send a copy to CHM.

You can submit your bill online or via snail mail. You’ll also send along a completed member bill processing form.

4. Then you pay the bill yourself.

You can either pay the bill in full or via a payment plan while your member bill is being processed.

5. If your share request is approved, you’ll be reimbursed via check.

Yes, that does your medical bills will be paid for out-of-pocket until your reimbursement arrives.

Christian Healthcare Ministries says that many bills are reimbursed well under 120 days. But some can take up to 120 days or slightly longer.

https://www.youtube.com/watch?v=WMjqzSOG0fE

I talked to my buddy, Scott, and he confirmed that most of their bills have reimbursed in well under 120 days. But he did bring up something that should be pointed out.

If you’re dealing with massive bills, even paying bills on a payment plan can be difficult.

For instance, Eleanor once had a procedure that cost over $250,000. Even the down payment on a $250,000 procedure is generally going to be $25,000 or more. And then each month’s payment could be $5,000 or more.

So Scott said that he and Sarah have had to get crafty on how to swing things until they receive their reimbursement. Yes, it’s true that their situation is unusual. But it’s still important to point out.

How Discounts Can Minimize Your Out-of-Pocket Costs

Member of the Silver and Bronze programs are offered a unique benefit that could save you a lot of money. Your personal responsibility can be reached in one of two ways:

- By the money that you actually spend, OR

- By receiving that amount of money in provider discounts.

Let me give an example. Let’s say you break your arm and have to go to the hospital. The bill will be $5,000. But you tell the hospital billing staff that you’re self-pay, so they give you a $1,000 discount, bringing the bill down to $4,000.

In that case, this would count as hitting your personal responsibility on the Silver plan. So you would pay the hospital $4,000 and you’d be reimbursed by CHM for the full amount.

So when it’s all said and done, you don’t actually spend any money out-of-pocket. That’s a huge benefit that makes the Silver and Bronze plans much more attractive.

The Plans That We Chose

We decided to add Kendall to the Gold program and to add me to the Bronze program. I virtually never go to the doctor, so I’m only looking for coverage for a true emergency (a hospitalization).

But I wanted more coverage for Kendall. Plus, the Gold Program offers great maternity benefits (more on that later). So here’s how much we’re paying per month:

- Kendall’s coverage: $150 (Gold Program)

- My coverage: $45 (Bronze Program)

- Total monthly cost: $195

In our situation, our kids are still covered until the end of the year through CHIP (Florida’s Children’s Health Insurance Program). But next year, we plan to add them to the Gold Level. So, at that point, our monthly cost will jump to $345.

I also signed us up for the Brother’s Keeper Program, which gives us access to additional cost support. We’ll need to send an extra quarterly gift to remain in the Brother’s Keeper Program. Christian Healthcare Ministries says that the average Brother’s Keeper quarterly gift is $25 per membership unit.

Finally, I should mention that my buddy Scott has been on my case for being a cheapskate and not putting myself on the Gold program. I may decide to switch eventually if he’s able to wear me down. In that case, our bill would jump to $450 for the entire family.

And that would be our max cost forever, even if we were to add several more children in the future.

Christian Healthcare Ministries Coverage

Ok, so let’s talk about what Christian Healthcare Ministries will and will not cover.

What Christian Healthcare Ministries Will Cover

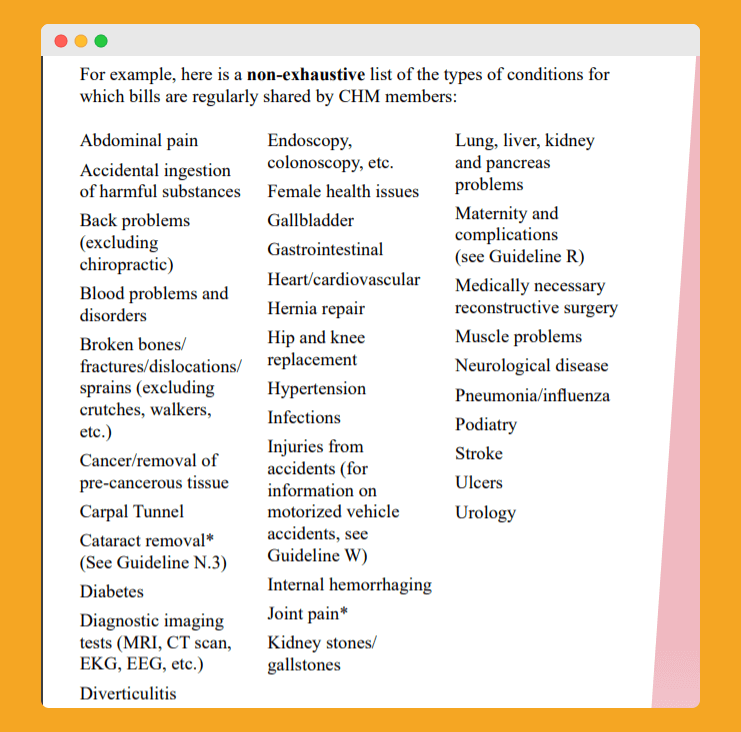

Here’s a quick quote from their CHM guidelines about the types of procedures that are covered.

Christian Healthcare Ministries members share bills for procedures that are generally accepted by the medical community and that are researched, published in reputable medical journals subject to peer review, widely understood and accepted as mainstream medical treatment and have properly listed common procedural treatment (CPT) codes.

And here’s a list that they provide showing the types of medical expenses that are eligible for sharing.

What Christian HealthCare Ministries Will Not Cover

Here is a quick list of expenses that are ineligible for coverage with CHM:

- Alternative treatment (naturopaths, homeopaths, acupuncture, etc.)

- Chiropractic care

- Routine visits and checkups totaling less than your personal responsibility amount

- Immunizations and vaccinations

- Dental expenses (with the exception of some bills for the repair of broken teeth)

- Vision correction (eye exams, glasses, contact lenses, etc.)

- Hearing exams and hearing aids

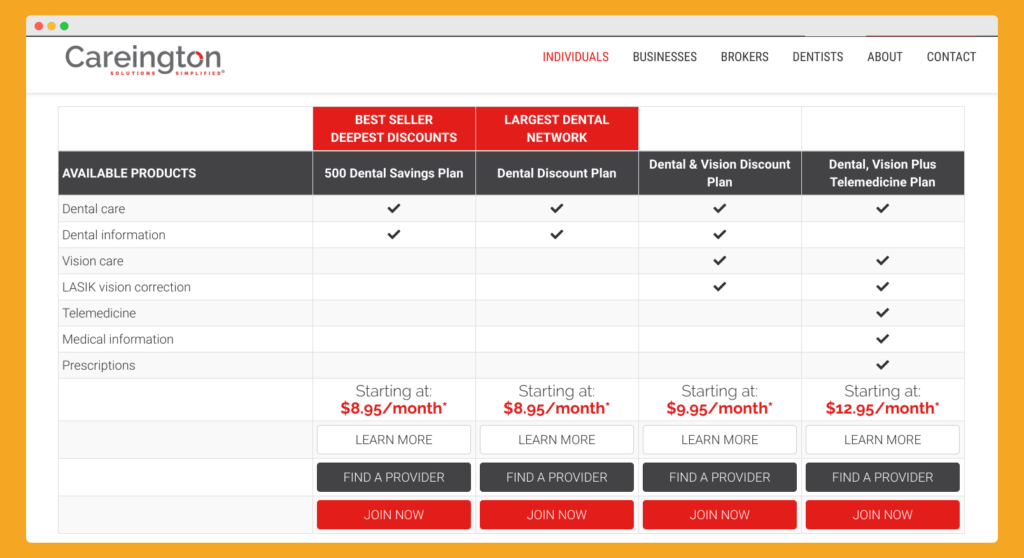

It’s a bit of a bummer that CHM doesn’t cover vision, dental, hearing, and chiropractic care. And the fact that they don’t cover vaccinations could really cause some hassle for parents.

Christian Healthcare Ministries recognizes that some of these are legitimate medical disciplines, their ministry is really designed to cover more costly medical bills.

In our case, we know that we’re saving hundreds of dollars with CHM vs traditional health insurance. So we plan to put a little of that savings away each month in a savings account to cover these types of expenses.

Also, we’re considering joining Careington, which CHM recommends for getting dental and vision discounts and free telemedicine services.

What Christian Healthcare Ministries Will Only Cover At the Gold Membership Level

Ok, so there are certain expenses that are only covered (or only on a limited basis) if you’re a Gold Level member. These are the expenses that fit into that category.

Maternity

To be eligible for maternity coverage, you’ll need to join CHM at least 300 days before your delivery date. CHM says that for most people that means waiting 30 days after joining before becoming pregnant.

Silver and Bronze members are eligible for maternity coverage, but it is very limited. The only bills that are eligible for sharing are those that are incurred as a patient of the hospital and above your personal responsibility. No prenatal or post-natal services are eligible for sharing at these membership levels.

However, Gold Level members truly receive the gold-standard treatment. Here’s a list of all the maternity expenses that are eligible for sharing once you reach $500 in expenses per pregnancy.

- Pre-natal (including up to three ultrasounds)

- Hospital delivery (including cesarean and multiple births)

- Home births

- Midwives

- Complications

- Post-natal (up to six weeks) for mom and baby

- One lactation consultant (if medically necessary)

This is truly fantastic maternity coverage and is the primary reason why we opted to add my wife to the Gold program.

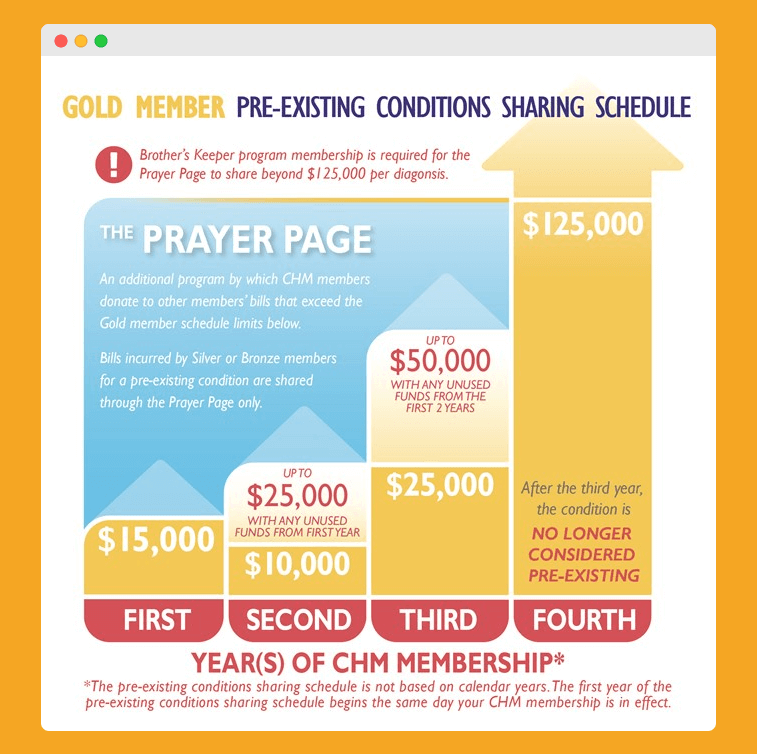

Pre-Existing Conditions

Christian Healthcare Ministries defines a pre-existing condition as:

Any medical condition for which you experience signs, symptoms, testing or treatment before joining Christian Healthcare Ministries (CHM), even if you have not been diagnosed.

Coverage for pre-existing conditions is only available to Gold members.

If you are a Gold member, here’s how much help you can receive each year for bills related to pre-existing conditions.

- Year 1: $15,000

- Year 2:

- $10,000 of additional sharing

- $25,000 in total shared expenses (including any used funds from Years 1)

- Year 3:

- $25,000 of additional sharing

- $50,000 in total shared expenses (including any unused funds from Years 1 and 2)

- Year 4: The condition is no longer considered pre-existing and is fully eligible for sharing

Silver and Bronze members can ask for financial help with bills related to pre-existing conditions via CHM’s “Prayer Page.” But assistance isn’t guaranteed.

Speaking of the Prayer Page, Scott wanted me to share mention that it’s been one of the most uplifting parts of their experience with CHM. Not only have they received financial support, but they’ve received countless letters from members all over the country letting them know that they’ve been praying for Eleanor.

That’s totally awesome. And it’s an intangible benefit of CHM that traditional insurance will never be able to match.

Prescriptions

Prescriptions are not eligible for sharing with the Silver and Gold plans. However, incident-related prescriptions are eligible for sharing on the Gold plan after you’ve met your $500 personal responsibility.

Therapy (Physical Therapy, Occupational Therapy, Speech Therapy)

Only Gold members are eligible to receive financial assistance for therapy sessions. They can receive up to 45 sessions of therapy necessary because of a qualifying injury or sickness. Therapy sessions must be ordered by a medical doctor.

It’s important to point out that the cap is 45 sessions combined. For instance, you could have 30 physical therapy, 20 occupational therapy sessions, and 5 speech therapy sessions.

Nursing Facilities, Rehab Centers, and Step-Down Facilities

Once again, CHM will only share expenses from these types of facilities for Gold members. And, even then, the duration of the stay must be 20 days or less.

What is Brother’s Keeper?

CHM members at any level can access additional financial support by signing up for Brother’s Keeper. To join the program, you’ll need to pay a non-refundable $40 fee per membership unit. And you’ll also need to send a quarterly gift of your choosing.

Once you’ve joined Brother’s Keeper, here are the extra coverage that you’ll receive, depending on your membership level.

- Gold members: You’ll get unlimited cost support per illness

- Silver and Bronze members: You’ll get an additional $100,000 of cost support per each membership renewal, up to $1 million.

Brother’s Keeper is a great way to protect yourself against the cost of a catastrophic illness like Scott and Sarah faced with Eleanor. Thankfully, they had added Eleanor to the Gold Level program and they were Brother’s Keeper members.

I would highly recommend that Christian Healthcare Ministries members join the Brother’s Keeper program if at all possible.

What Are the Alternatives to Christian Healthcare Ministries?

Before you sign up for CHM, you need to make sure that it’s the right fit for your situation. I highly recommend that you get quotes from multiple healthcare sharing ministries before making your choice.

Here are three of CHM’s top competitors:

Also, depending on your financial situation, you may be eligible for subsidized traditional health insurance on the Marketplace. If so, traditional health insurance could still provide the most bang for your buck.

Finally, may want to consider joining a telemedicine service like Careington or HealthSapiens. For less than $30 a month, you could get unlimited 24/7 access to doctors via video, phone call, or email. Whether you choose a healthcare sharing ministry or traditional health insurance, a telemedicine subscription could save you money.

Conclusion:

Is Christian Healthcare Ministries going to be for everyone? Absolutely not.

For some families, a different healthcare sharing ministry may be a better fit. And for others, traditional insurance will still provide the most value for the money. But for our family’s situation, CHM just seemed to check all the boxes.

Are you a Christian Healthcare Ministries member? If so, I’d love to hear about your experience in the comments!

Christian Healthcare Minstries is a rip off! When I got pregnant and submitted my prenatal visit bills, they would never reimburse me. I was a gold member and followed all of their guidelines, but they always came up with a new excuse for what I needed to do to get reimbursed. I always did what they requested but in the end I was never reimbursed. So not only did I pay for months of being a gold member, but I also had to pay for prenatal visits and tests out of my own pocket that CHM was supposed to reimburse me for!

I’m so sorry to hear this. This is the first time I’ve heard of someone not being reimbursed by Christian Healthcare Ministries after following all of their guidelines. But thank you for sharing your story with the other readers.

My family and I are with Medi-Share and I hadn’t realized that CHM works so differently such as with the per-incident deductible. That’s a very interesting concept. I also love the idea behind Brother’s Keeper and the member getting to choose the quarterly gift.

The maternity coverage sounds excellent. If interested, here is what it was like for us on Medi-Share:

https://www.medisharereviews.com/blog/medi-share-and-pregnancy

There are pros such as the free 24/7 online doctor appointments for all members which can be very useful during pregnancy, but then again it sounds like a lot more expenses are shared with CHM!

Great article and when I come across people interested in CHM, I will definitely be linking them to this piece.

Hey Colin,

Yes, I’ve heard a lot of great things about Medi-Share. Just checked out your site and saw that you’ve got a ton of great content about them. I’ll definitely send people your way who are interested in what they have to offer.

Thanks for the comment!

Clint

Our family has been with CHM for over 13 years and have had our 3 children with their coverage. We were reimbursed according to their plans. We did pay up front for some services but at the end we were covered and everything worked out great.

That’s great to hear! Thanks for sharing about your first-hand experience, David.