If you’re wanting to save for your child’s college, opening a 529 college savings plan is a great idea. 529 plans are one of the only types of tax-sheltered accounts that allow for tax-free growth and withdrawals. And 529 funds can be used on a variety of school-related expenses like tuition, books, and supplies.

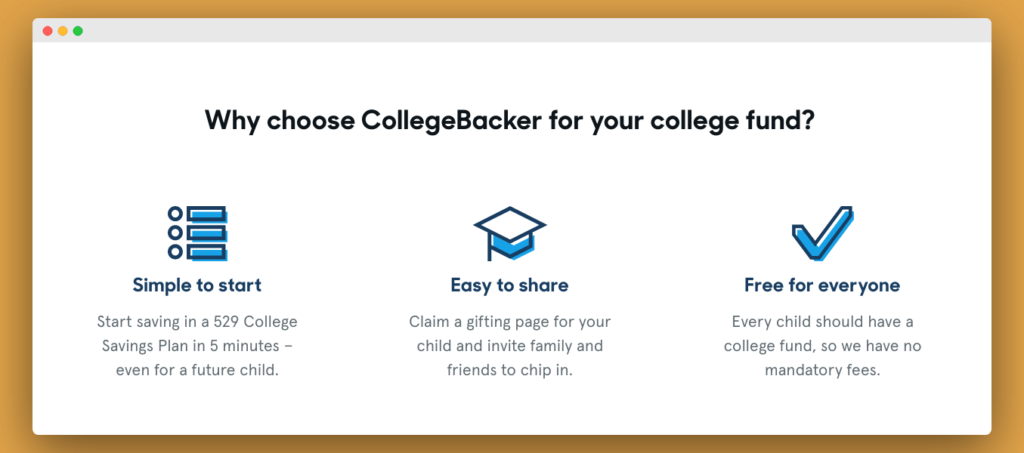

But opening a 529 account can be cumbersome. And it can be difficult to involve family and friends in the saving process. That’s where CollegeBacker comes in. Their goal is to simplify the process of saving for a child’s college education in a 529 plan. And they even add in a social flair.

To learn more about what CollegeBacker has to offer, continue reading our full CollegeBacker review.

It’s simple

If you’ve been avoiding opening a 529 plan because you haven’t been able to work up the gumption to deal with the application process, CollegeBacker has taken away that excuse. They’ve taken all of the hassle out of opening a 529 account. You can literally have your account up and running in 5 minutes and with a minimum investment of only $25.

CollegeBacker’s will automatically invest your child’s money in more conservative investment choice as they near graduation. And you can even open an account for a future child, although I wouldn’t recommend that.

It’s social

CollegeBacker makes it easy for your family and friends to chip in towards your child’s education savings. With only a few clicks, people can send money your way. And once you redeem the gift, it will immediately be invested in your child’s 529 plan.

Grandma and Grandpa can even set up a monthly contribution and get updates on your child’s progress. Having a birthday party soon? CollegeBacker says you can even invite all your party guests to contribute to the fund…although I’m not sure how well that will go over with your student.

And by claiming a gifting page for your child, anyone can get involved with your child’s education and monitor their progress. It’s like the “Go Fund Me” of 529 plans. And, honestly, its a pretty cool idea.

It’s affordable

One of the cool things about CollegeBacker is that they don’t charge any mandatory fees whatsoever. They think everyone should be able to get involved with saving for a child’s education. As opposed to charging a percentage of assets under management like many advisors, CollegeBacker is completely donation-based.

If you want, you can make a monthly donation of $1 to $10. Or you can choose to pay nothing at all if you can’t afford to make a donation yet, or you’re just getting your feet wet.

It’s important to point out that your investments will have their own embedded costs, called expense ratios. Once you’re up and running with CollegeBacker, you’ll want to see which investment options are available to you. Do your best to find funds that have reasonable expense ratios.

Unfortunately, CollegeBacker does charge a 2.9% plus $2.95 fee when contributions are made via credit card or debit card. That’s a big bummer. And it seems especially strange for a company that so heavily emphasizes community involvement online.

It’s limited

If you’re familiar with 529 plans, you may know that every state has its own plan. Some state plans are better than others. Depending on where you live, you may be eligible for income tax deductions or credits by choosing your state’s plan.

Related: How much is your state’s 529 plan tax deduction really worth?

Unfortunately, you can’t pick and choose from all the state plans with CollegeBacker. As of now, they only have one plan to choose from. They say that their 529 plan was hand-picked as one of the best available. But if you live in a state that has a superior 529 plan, you may be better off opening a state plan directly.

If you want to use your state’s plan and CollegeBacker’s at the same time, you can. By doing so, you can leverage the tax benefit of your state plan and then CollegeBaker for the community giving piece. which they save averages above 40% additional savings for families.

Conclusion:

There’s a lot to like about CollegBacker. I’m all for any company that makes it easier to start saving for a child’s education in a 529 plan. And I love that they make it super simple to get grandmas and grandpas and aunts and uncles on the savings train.

But if you live somewhere that offers special tax incentives on state-sponsored plans, they could be well worth the extra effort required. If you do go with a state plan, you’ll just have to resort to asking people to send money an old-fashioned way…which grandma and grandpa will probably be totally fine with.

Saying there is no fee is misleading. While there may be no fee for the one opening the fund, I get charged almost 12% in handling fees every time I donate to my great grandson’s fund.

Twelve percent! Gosh, that does sound incredibly excessive. Would it be possible for you to send me a screenshot of your payments screen so I can see exactly what they’re charging you? I’d like to update this article to reflect this issue. My email address is clint@walletwiseguy.com.

Thanks so much for helping me get the best information out to the readers!

Clint

There is a donation that automatically pops in, but you can change the donation to $0. I also just linked my chase account and there was no extra charge. In other words, you can make it completely free to use, just need to do it the “right” way.

Ah that’s very helpful information. Thanks for sharing!

As a parent, , yes you can insert 0 for a donation, but as a grand parent, as above who is getting charged 12%, this is excessive. Per their Policy, it stated if a credit or debit card is used you will get a fee attached. 2.9% plus 2.95. Also per hand book as I understand they may charge more. Hummm, the old saying, nothing is free? And after all it is a business.

Just wondering, maybe it does need clarification.

Thanks

A concerned Grand Ma

A PS to my comments, also reguarding Marge’s comment regarding the 12%, I found on Consumer Reports that after hitting 5,000.00, a fee of 0.05% is charged, on the invested amount.

Hi Judy, thanks for the heads up on both of these fees. I’m going to reach out the CollegeBacker team for clarification and once I’ve heard back I’ll update the article with the new info.

Thanks again!

Clint