No-fee trades have made quite the splash in the news lately. JP Morgan just announced their new investing platform, called You Invest, offering all customers 100 commission-free online stock and ETF trades. And all signs point to more brokerage firms following JP Morgan’s lead sooner rather than later. If the idea of free trades sounds enticing to you, you really have one company to thank for all this – Robinhood.

Robinhood – Following in Netflix and Amazon’s Footsteps

It all began last year when Robinhood began offering its investors free trades of stocks and ETFs. Robinhood wisely aimed their marketing at young investors, under 30 years of age. They had a feeling that millennials wanted to be involved in the stock market but the price of making trades was keeping many away.

And it looks like they were right. As of today, Robinhood has grown to over 5 millions users, making it a larger trading platform than E-Trade!

Robinhood’s move may very well shake up the investing industry in a similar fashion to how Netflix transformed the entertainment industry and Amazon the shopping industry. If there’s one financial rule, for better or worse, that you can count on with consumers in their 20s and 30s, it’s that they don’t like to pay for products or services on a per-transaction basis.

Who wants to rent movies one at a time at Blockbuster when you can watch an unlimited number of movies and shows with a monthly subscription?

Who wants to pay for shipping on every single purchase when you can get free shipping on an unlimited number of purchases with an annual Amazon Prime subscription?

Now we all know that this doesn’t always save the consumer money. Oftentimes you would actually come out ahead by paying for things one at a time, but that is beside the point. Regardless of its financial efficiency, this is the mindset that most millennials are inclined towards.

This same mindset is what causes millennials to balk at the idea of paying per-trade on investing platforms. Am I saying that I expect brokers in the future to move to a monthly subscription-based pricing model? No, not necessarily (although I have a feeling that such a model would be quite successful). I’m simply showing why services that remove per-transaction costs attract young people, and why Robinhood has grown so rapidly.

With Robinhood’s success, it was only a matter of time before some of the bigger players decided to get a piece of the action. The truth is brokers can continue to make money without charging fees per-trade by investing the cash that is left over in users’ accounts and charging for additional services. Charles Schwab for instance, says only 9% of its annual revenue comes from trade fees and commissions.

Today, Vanguard is already offering 1,800 free ETFs to trade, and Schwab and Fidelity offer free ETF trades on their in-house ETFs. With You Invest, JP Morgan is the first major broker to offer free trades on all stocks and ETFs. But make no mistake, this is only the beginning. I expect similar fee-cutting announcements from many of the major players over the course of the next several months.

At this point, I believe the industry shift to low-cost or free trades as a norm is inevitable. The question is how will this new, emerging investing landscape affect you, as a young investor, and your investing goals?

Lower Fees Do Make a Big Difference Over Time

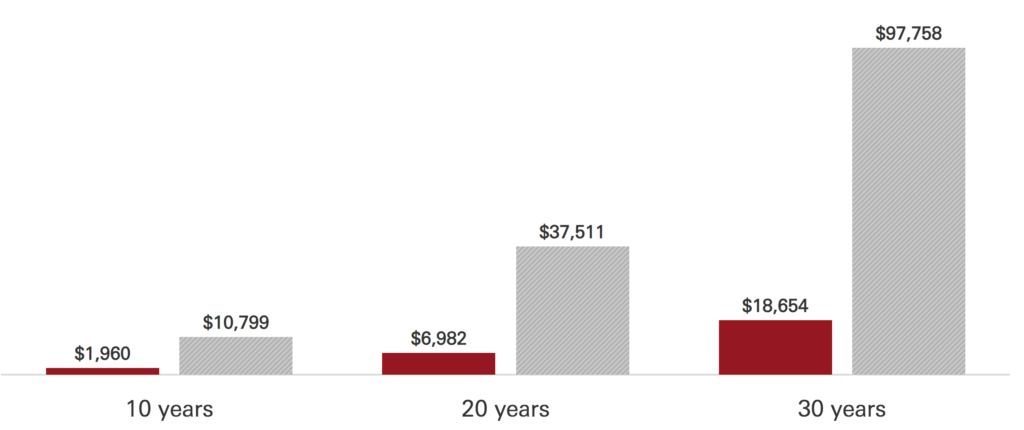

Despite what the high-cost brokers want you to believe, cutting costs does impact your level of success as an investor. Vanguard, who effectively pioneered the low-cost mutual fund broker category, shows in the chart below how much more money you would earn on a $100,000 initial investment with an expense ratio of 0.11% (Vanguard’s average expense ratio) vs 0.62 (the industry average expense ratio).

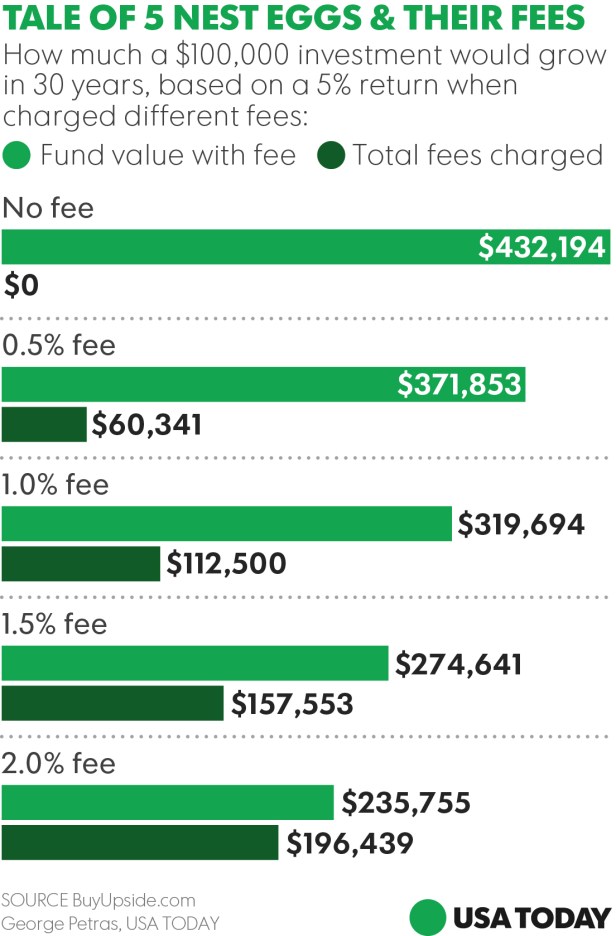

In another example, the USA Today chart below shows a $100,000 portfolio’s expected growth when charged fees between $0 and 2%.

The examples above show why we teach that cutting costs are one of the 4 bedrock principles of investing that you must follow if you are going to succeed as an investor in your 20s and 30s.

No-Fee Trades are Fraught With Temptation

If cutting costs is always a good thing as an investor, then no-fee trade apps must be a no-brainer, right? Well, not so fast. While there’s nothing inherently wrong with being able to execute no-free trades, the ability to do so could lead to undisciplined and emotional investing decisions. You see, cutting brokerage costs and mutual fund expense ratios are all part of a diversified, buy-and-hold, investing strategy.

Timing the Market

In our investing guide, we strongly advise against trying to time the market as an investor. However, no-fee trades could tempt investors to do just that. You may be more prone to jump in and out of stock positions too quickly. This also racks up short-term capital gains, which are taxed as regular income. If you do plan to use a no-fee trading platform, this shouldn’t negate the fact that buy-and-hold is still your best strategy for success. Don’t let the excitement of no-fee trades cause you to abandon your investing principles.

Diversification

It’s important note that most brokerage firms already offer free trades on their in-house mutual funds (including their low-cost index funds). For this reason, mutual funds have traditionally been attractive to investors due to their low-cost and the diversification they offered. Now that free trades on stocks are here, the main advantage that mutual funds offer over individuals stocks is the diversification they afford you…but this is a big advantage!

With stock trades being free, young investors may be more prone to invest all their money in a few random stocks, or to invest their money in whichever stock is in the news at the time. This is very dangerous. If the 1 or 2 companies that you are invested in tank, then you are sunk. Mutual funds protect you from this.

So while they may seem boring now that you can trade stocks for free, mutual funds are still an essential investment vehicle. And while ETFs offer many of the same benefits of mutual funds, they don’t allow for dollar-cost averaging.

If you are going to invest in individuals stocks, I would begin with choosing stocks in the S&P 500 that have had over 20 years of success. This would be stocks like Coke, Pepsi, Walmart, Proctor & Gamble, etc. And again, you need to plan to buy-and-hold, because each and every stock will have its ups and downs.

Conclusion

I love that these new apps are pushing brokerages to make their products more affordable to more consumers. However, low-cost trading does not give investors reason to abandon the time-honored universal truths of how to be a wise investor.