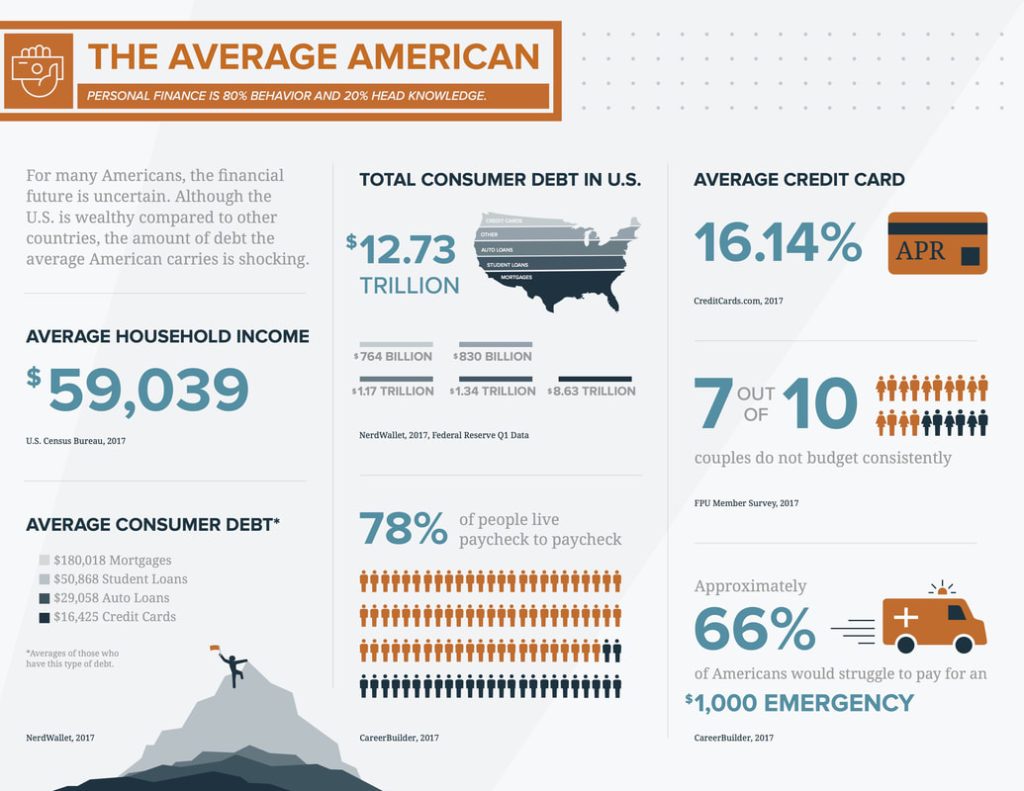

If you were to ask most people to name their single greatest money issue, the answers no doubt would vary; but, there’s a good chance some of the answers would include: needing a higher income, the high cost of living, and unexpected emergency costs. But the truth of the matter is, for most of us, that’s not truly our greatest money problem. The graphic above from Ramsey Solutions sheds light on the real money struggle for the “Average American.”

Yes, that’s right, learning to be content with what you have is the #1 key to our financial success. Why do I say that? Let’s break down the above graphic to see why.

The first number that jumps out at me is the average household income – $59,039. What this means is that the average American is living well above the poverty level, and, in fact, should easily be able to pay their bills and live a fairly comfortable lifestyle.

Now, remember, we’re talking about the average American here. Are there exceptions to this rule? Absolutely. Are there families that are trying to live off excruciatingly low incomes? Without a doubt.

Are there families suffocating under extreme medical debt from a medical tragedy that was outside of their control? To be sure.

But we’re not talking about the exceptions here. We’re talking about the average American.

If only the incredibly poor struggled with money, then we would be having a different discussion. But the infographic above doesn’t show that only individuals living below the poverty line live paycheck to paycheck or only those who have suffered a medical emergency. No, a whopping 78% of Americans do!

So, let’s combine these two facts together. (1) The average American has a high enough income to pay their bills without using credit and put a little money in savings each month, and (2) The average American doesn’t do either of these things!

Hence why I say that the biggest hurdle that you will have to cross in order to win at money is to learn contentment.

Oftentimes, studies have been conducted that ask the participants how much money they would need to feel secure. And do you know what the answers nearly always are? Exactly double of what the person was currently making.

This is universally the feeling of those who are making $35,000 and those who are making $70,000.

What does this tell us? That as our income goes up, our desire for more typically goes up just as quickly.

If you are not careful and do not have clear, written out financial goals, you will quickly find ways to spend every raise that you ever receive throughout your life. Your lifestyle will always adjust to meet your income, and you will never get ahead.

The infographic really sums it all up nicely when it says, “Personal finance is 80% behavior and 20% head knowledge.” You have to make a choice to be content “with such things as you have.”

Or you can just be another average American. It’s your choice.